Goal:

Use existing facility capacity more efficiently and increase transportation options.

Objectives:

The transportation system in the Boston region is, to a certain extent, increasingly stressed by the overall growth and success of the region’s economy. Congestion on the region’s roadways is reducing vehicular speeds, while the transit system is strained by high ridership and an aging infrastructure. Usage of the transportation network, both the roadway and transit systems, is projected to increase more during the time period covered by the Boston Region Metropolitan Planning Organization’s (MPO) next Long-Range Transportation Plan (LRTP), Destination 2040. In pursuit of the MPO’s core goals, the MPO and other stakeholders must find a way to manage the network’s capacity with limited capital funding to maximize mobility for all residents and users of the transportation network, including bicyclists and pedestrians.

Transportation capacity in a metropolitan region has important ramifications for the region’s economic health and quality of life, both in the present and the future. As the data and analysis presented in this document demonstrate, the Boston region confronts a sort of policy paradox: a booming economy and a rapid population growth—especially in the core of the region—paired with increasing congestion and a public transit system that is aging and unreliable. These factors combine to stress the transportation network’s overall capacity, creating significant challenges to convenient mobility across all modes for the residents and users of the MPO area’s transportation network. Awareness of the stress on the system appears to be rising among the media and the public, and pressure on policymakers to restore mobility may be on the rise.1

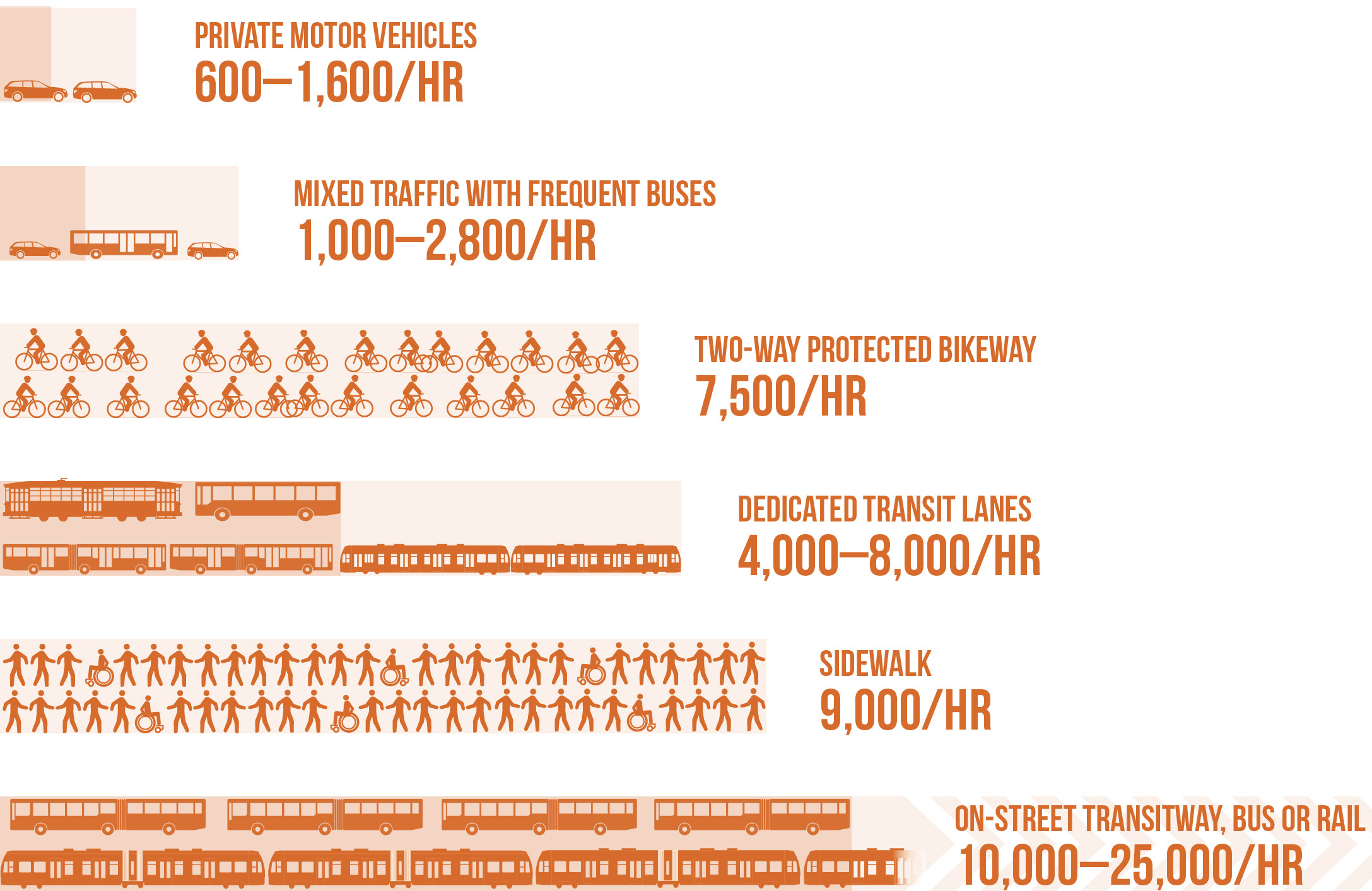

The MPO’s capacity management and mobility goal and objectives seek to expand users’ travel options to reach principal destinations. They respond to federal, state, and regional policies and activities to increase transit, bicycle, and pedestrian travel, and to the increasing demand for transit, bicycle, and pedestrian connections by communities throughout the region. With limited finances for expansion, the MPO needs to work with other responsible agencies and entities to address the challenge of setting policy and priorities to create as much capacity as possible from the existing system. As studies and analyses by the MPO and other agencies have shown, in many situations, the least technically complex and least capital-intensive path to creating additional overall network capacity is to reallocate space on the existing road network to the modes that have the capacity to move the highest possible number of users in a given space. Figure 6-1 demonstrates this dynamic for a typical city street.

Figure 6-1

Overall Person Throughput Capacity of a Typical Lane by Mode

Source: National Association of City Transportation Officials (NACTO) Transit Street Design Guide, https://nacto.org/publication/transit-street-design-guide/introduction/why/designing-move-people.

MPO staff identified the following key factors that will affect the MPO’s Capacity Management and Mobility goal area in the future. These factors are consistent with key challenges that have been identified in the report, Choices for Stewardship: Recommendations to Meet the Transportation Future, released in December 2018 by the Commission on the Future of Transportation in the Commonwealth—a high-level report intended to guide the future of transportation policy and planning in Massachusetts. These key factors include:

One of the major challenges facing the MPO and other policymaking stakeholders and agencies is the preservation and enhancement of mobility options when economic growth and trip-making are concentrated in a limited geographic area. Economic growth in the Boston region outpaces that in the rest of the state, and growth in the Inner Core subregion is projected to continue at a faster rate than in the rest of the Boston region. The increase in the number of trips made in the Boston region is increasing congestion on a network that is either at capacity or nearing it. In an area where adding roadway capacity for vehicles is challenging, the MPO and other policymaking entities have the opportunity to work with municipalities to reallocate road space to accommodate all modes of travel.

The regional transit system has also been stressed over the past several years, and continues to struggle by some measures. The Massachusetts Bay Transportation Authority (MBTA) has plans and capital projects underway to modernize and increase capacity on much of the rapid transit system. The MBTA recently conducted the Better Bus Project which proposed changes to bus service based on research and partnerships with municipalities. This project and potential MPO and municipal projects and programs provide an opportunity to improve the reliability, capacity, and quality of the bus network with a relatively low capital expenditure. The MBTA has also launched the Rail Vision study to examine the future of the commuter rail network, a topic which MPO staff heard discussed many times during public outreach events.

Table 6-1 summarizes key findings regarding capacity management and mobility needs that MPO staff identified through data analysis and public input. It also includes staff recommendations for addressing each need. Chapter 10—Recommendations to Address Transportation Needs in the Region—provides more detail on each of the recommendations. The MPO board should consider these findings and recommendations when prioritizing programs and projects to receive funding in the LRTP and Transportation Improvement Program (TIP), and when selecting studies and activities for inclusion in the Unified Planning Work Program (UPWP).

Table 6-1

Capacity Management and Mobility Needs in the Boston Region Identified through Data Analysis and Public Outreach and Recommendations to Address Needs

| Emphasis Area |

Issue |

Needs |

Recommendations to Address Needs |

|---|---|---|---|

Roadway |

Congestion and slower speeds |

Address congestion on expressways, interchanges, and arterials. |

Existing Programs Major Infrastructure Program Bottleneck Program Freight Program Existing Studies Addressing Priority Corridors from the LRTP Needs Assessment Addressing Safety, Mobility, and Access on Subregional Priority Roadways Low-Cost Improvements to Express Highway Bottlenecks Proposed Studies Congestion Pricing Research Safety and Operations at Selected Intersections |

Roadway |

Bottlenecks |

Reduce congestion at bottleneck locations on the regional roadway network. |

Existing Programs Major Infrastructure Program Bottleneck Program Existing Study Low-Cost Improvements to Express Highway Bottlenecks Proposed Study Congestion Pricing Research |

Roadway |

Connected and autonomous vehicles |

Continue to monitor this technology because the schedule for its adoption and implementation, and its implications remain highly uncertain. |

Existing Study Tracking of Emerging Connected and Autonomous Vehicle Technologies |

Roadway |

Ride-hailing and TNCs |

Continue to monitor growth in TNC usage to determine if TNCs are diverting ridership and funds away from public transit, and contributing to congestion. The future of this mode is uncertain. |

Existing Program Community Transportation Program Proposed Program Connect Elderly Adults with Transportation Options Existing Studies Transportation Access Studies of Commercial Business Districts New and Emerging Metrics for Roadway Usage The Future of the Curb Proposed Studies Congestion Pricing Research Transit Revenue Analyses Research on TNCs Monitor TNC Adoption |

Roadway |

Car sharing |

Continue to monitor car sharing; it is poorly integrated with other modes and not accessible in all areas. The future of this mode is uncertain. |

Existing Program Community Transportation Program Proposed Program Coordinating Car Sharing and Transit |

Roadway |

Transportation demand management |

Continue to monitor TDM services. There is no region-wide strategy for TDM and relatively few municipalities in the Boston region have TDM ordinances. |

Existing Program Community Transportation Program Proposed Study Congestion Pricing Research |

Freight |

Congestion |

Reduce congestion on regional roadways to facilitate the movement of freight. |

Existing Programs Freight Program Major Infrastructure Program Bottleneck Program Proposed Programs Freight Database Existing Studies Addressing Priority Corridors from the LRTP Needs Assessment Addressing Safety, Mobility, and Access on Subregional Priority Roadways Low-Cost Improvements to Express Highway Bottlenecks New and Emerging Metrics for Roadway Usage Updates to Express Highway Volumes Charts Proposed Study Congestion Pricing Research |

Freight |

Contested curb and arterial road usage |

Reduce conflicts between automobiles and delivery trucks that are competing for curb space. |

Existing Studies Transportation Access Studies of Commercial Business Districts The Future of the Curb |

Freight |

Lack of data |

Develop reliable data sets on various freight topics. |

Existing Program Freight Program Proposed Program Freight Database |

Transit |

Access to transit |

Improve access to transit service that runs frequently, and increase capacity at park-and-ride lots that are at or approaching capacity. |

Existing Programs Park-and-Ride and Bicycle Parking Programs Regional Transit Service Planning Technical Assistance Community Transportation Program Proposed Programs Dedicated Bus Lane Program Enhanced Park-and-Ride Program Infrastructure Bank or Demonstration Materials Library Coordinating Car Sharing and Transit Existing Studies Transportation Access Studies of Commercial Business Districts Reverse Commute Areas Analysis The Future of the Curb) Proposed Study The role of dispatching and supervision in bus reliability and its application in the MBTA network |

Transit |

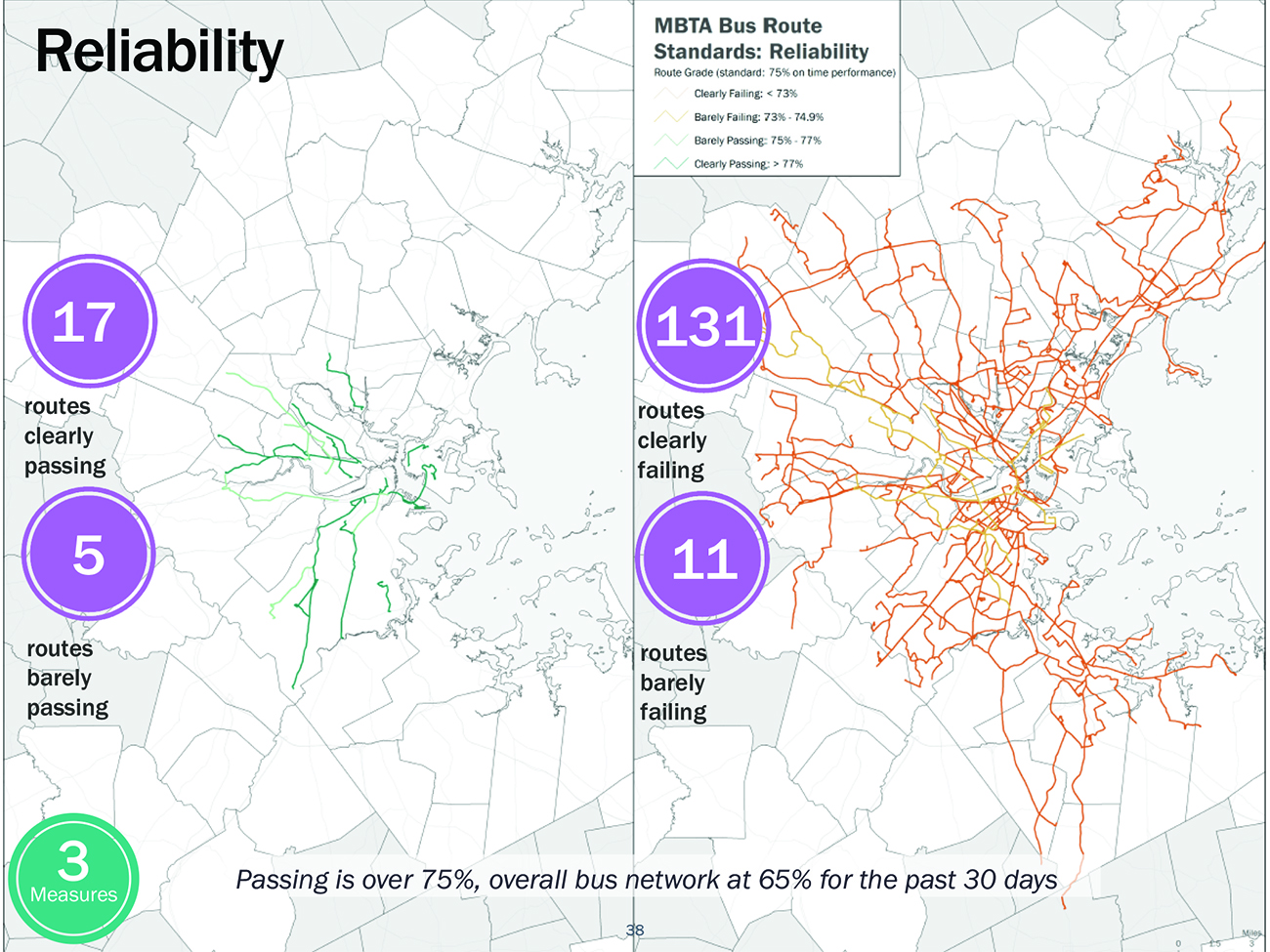

Bus speed and reliability |

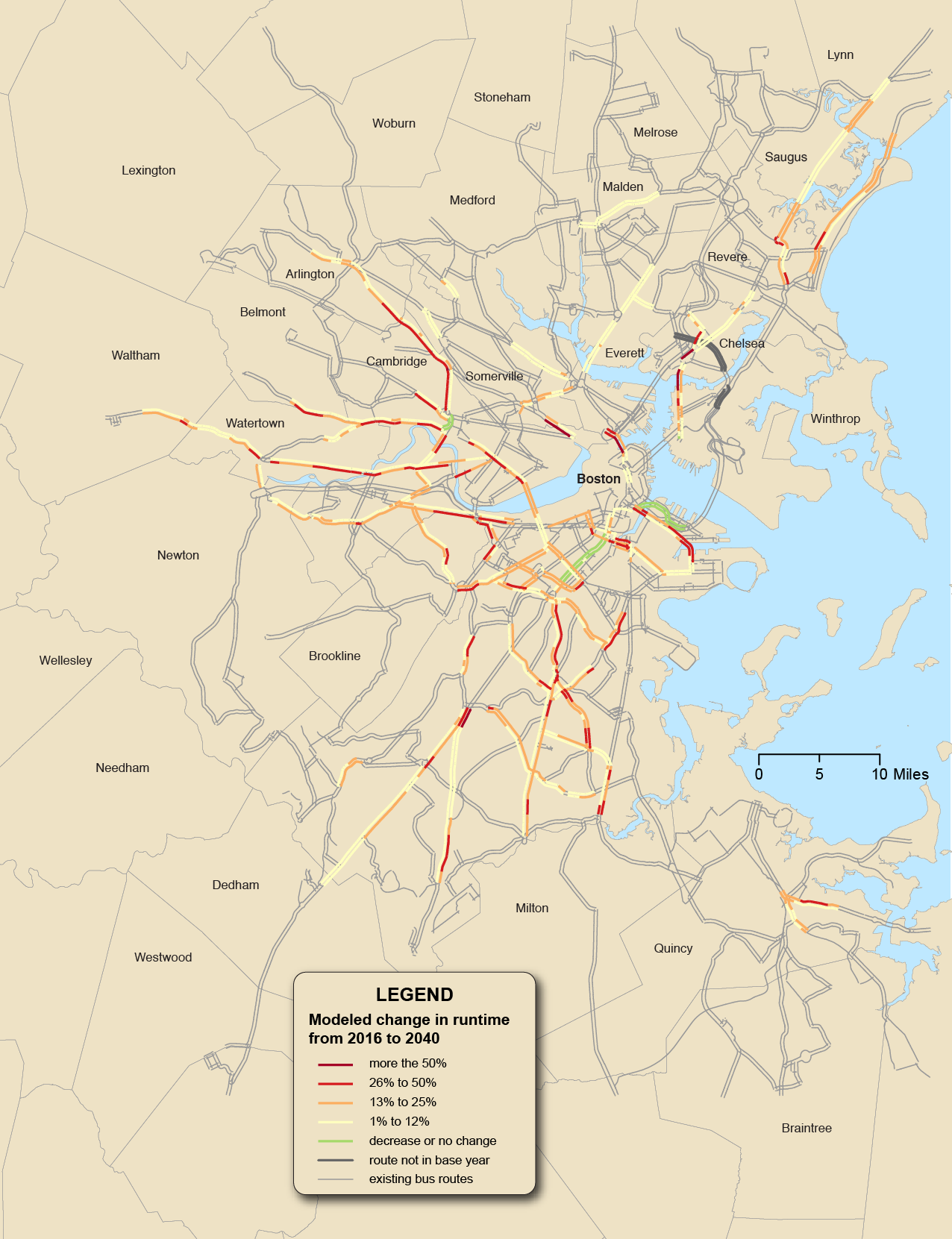

Improve the reliability of bus service. Bus speeds are projected to decline even further due to increasing congestion; the introduction of more dedicated bus lanes could be a potential solution. |

Existing Program Regional Transit Service Planning Technical Assistance Proposed Program Dedicated Bus Lane Program Existing Study The Future of the Curb Proposed Studies The role of dispatching and supervision in bus reliability and its application in the MBTA network Assist the MBTA in locating new or improved bus garage locations Congestion Pricing Research |

Transit |

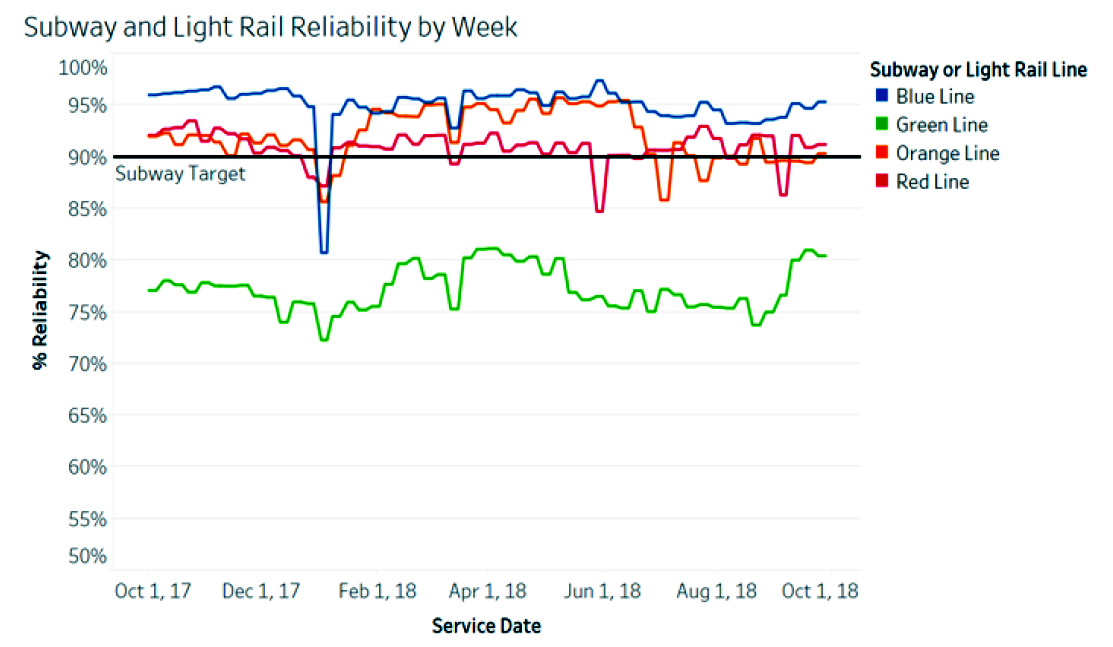

Rapid transit reliability |

Address increased delays resulting from the system’s aging rapid transit infrastructure. |

Proposed Studies Analyze peak capacity of the MBTA rapid transit system State and MPO Performance-based Planning Program |

Transit |

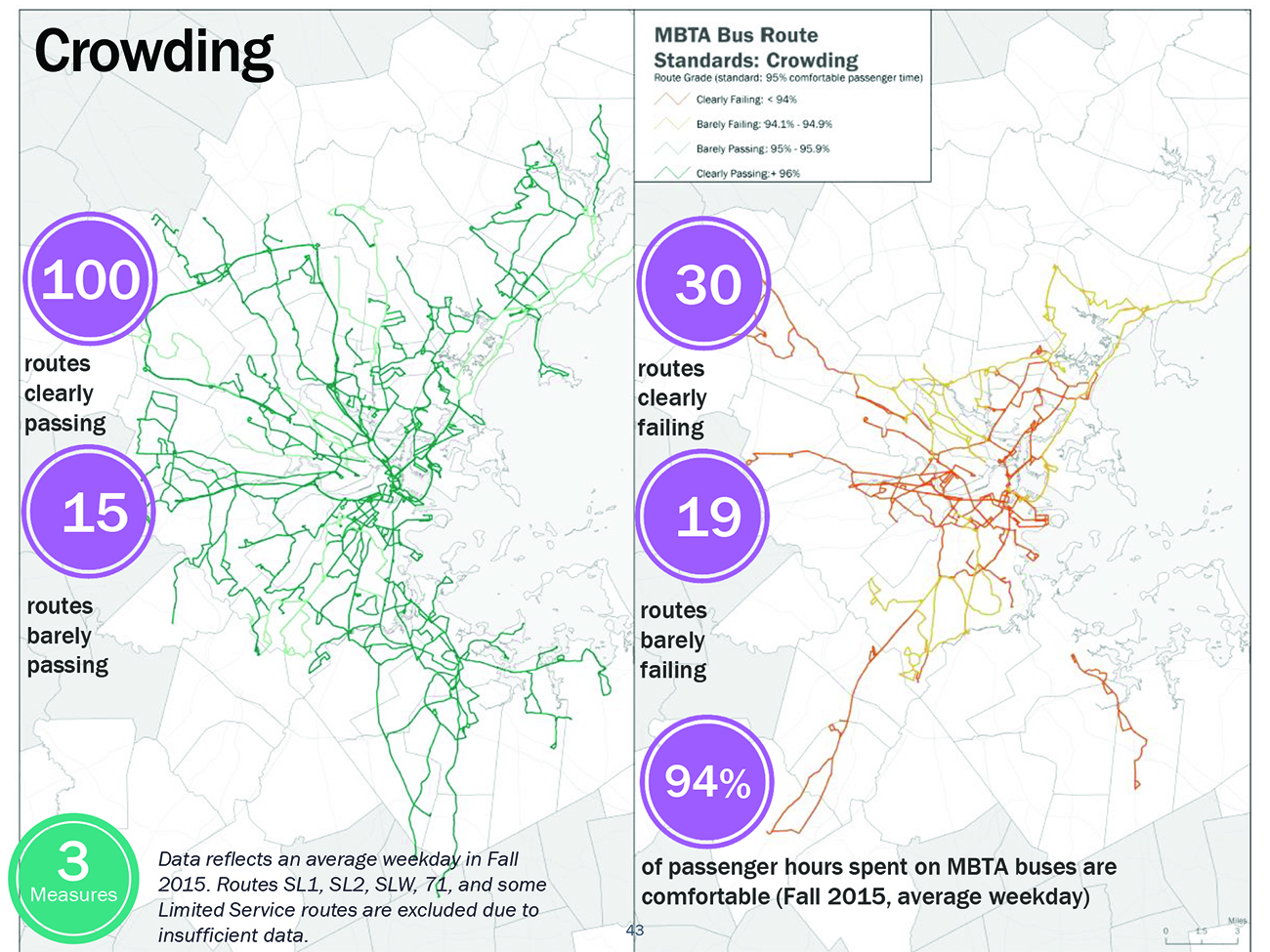

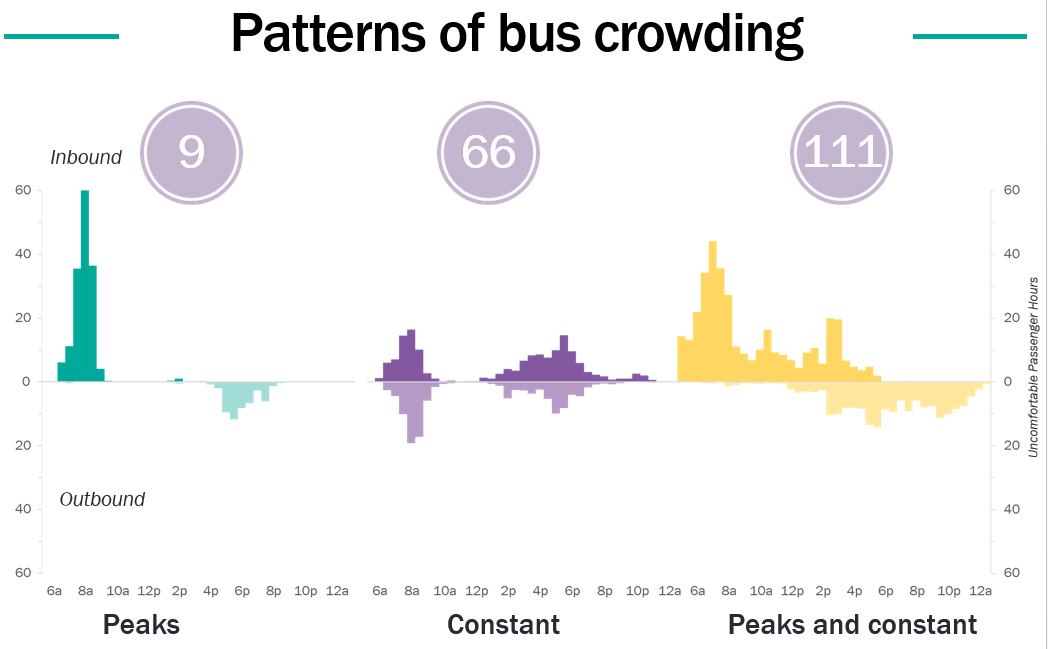

Crowding |

Address crowding on rapid transit lines and bus routes. According to a 2040 no-build scenario, crowding is projected to increase to unacceptable levels in some locations. |

Proposed Programs Dedicated Bus Lane Program Existing Study The Future of the Curb Proposed Studies The role of dispatching and supervision in bus reliability and its application in the MBTA network Analyze peak capacity of the MBTA rapid transit system |

Transit |

Bus maintenance facilities |

Address the need for sufficient MBTA garage space to fully modernize and/or expand the fleet. |

Proposed Study Assist the MBTA in locating new or improved bus garage locations |

Transit |

Commuter rail schedules |

Examine off-peak and reverse commute options. The commuter rail mostly serves commuter travel during the peak periods between the suburbs and the Boston Central Business District. |

Existing Study Reverse Commute Areas Analysis |

Transit |

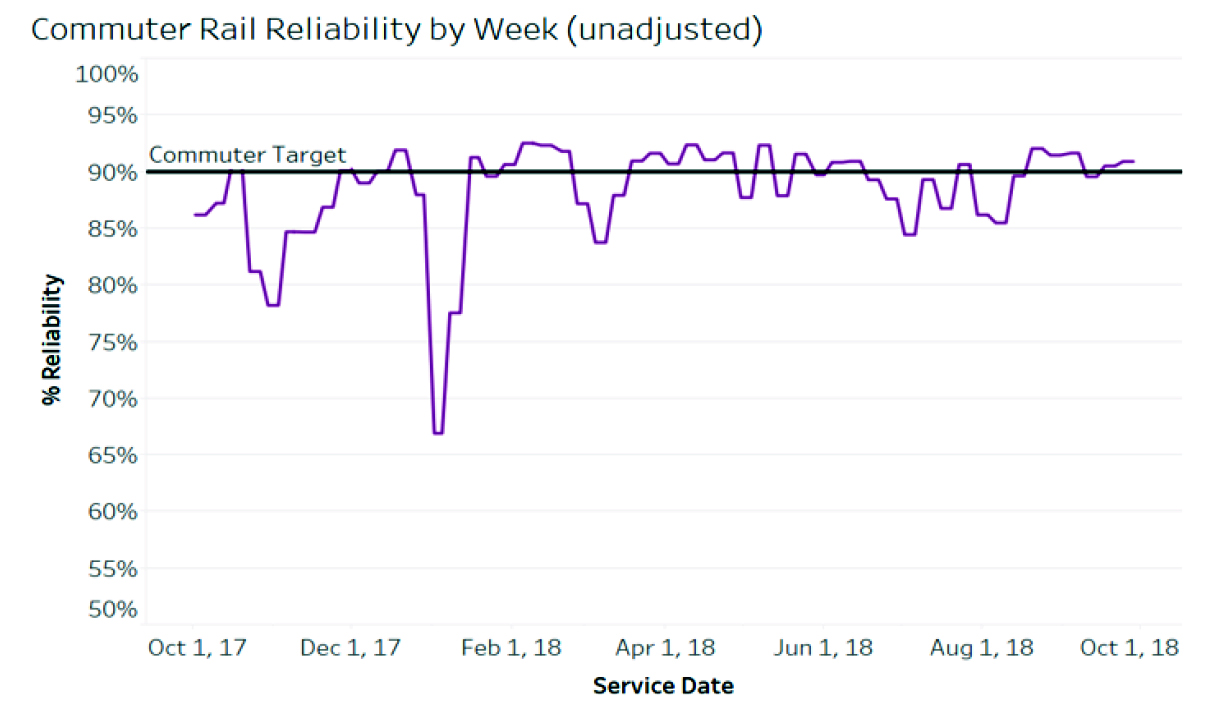

Commuter rail reliability |

Address aging equipment and infrastructure challenges facing the commuter rail fleet. The reliability of the commuter rail system is not as good as it could be. |

Existing Program State and MPO Performance-based Planning Program

|

Transit |

First-mile and last-mile connections |

Identify challenges to making first-mile and last-mile connections, which are major barriers to transit usage. |

Existing Programs Park-and-Ride and Bicycle Parking Programs Regional Transit Service Planning Technical Assistance Community Transportation Program Proposed Programs Enhanced Park-and-Ride Program Coordinating Car Sharing and Transit Existing Study Reverse Commute Areas Analysis |

Bicycle and Pedestrian |

Access to infrastructure |

Expand pedestrian and bicycle infrastructure so that residential areas and employment locations are close to good quality facilities conducive to regular usage. |

Existing Programs Bicycle and Pedestrian Program Bicycle and Pedestrian Support Activities Community Transportation Program Existing Studies Pedestrian Report Card Assessment Dashboard The Future of the Curb Proposed Studies Locations with High Bicycle and Pedestrian Crash Rates Region-wide Sidewalk Inventory |

Bicycle and Pedestrian |

Network construction |

Connect the disjointed elements of the bicycle network to create a cohesive network. |

Existing Programs Bicycle and Pedestrian Program Bicycle and Pedestrian Support Activities Community Transportation Program Existing Study Pedestrian Report Card Assessment Dashboard |

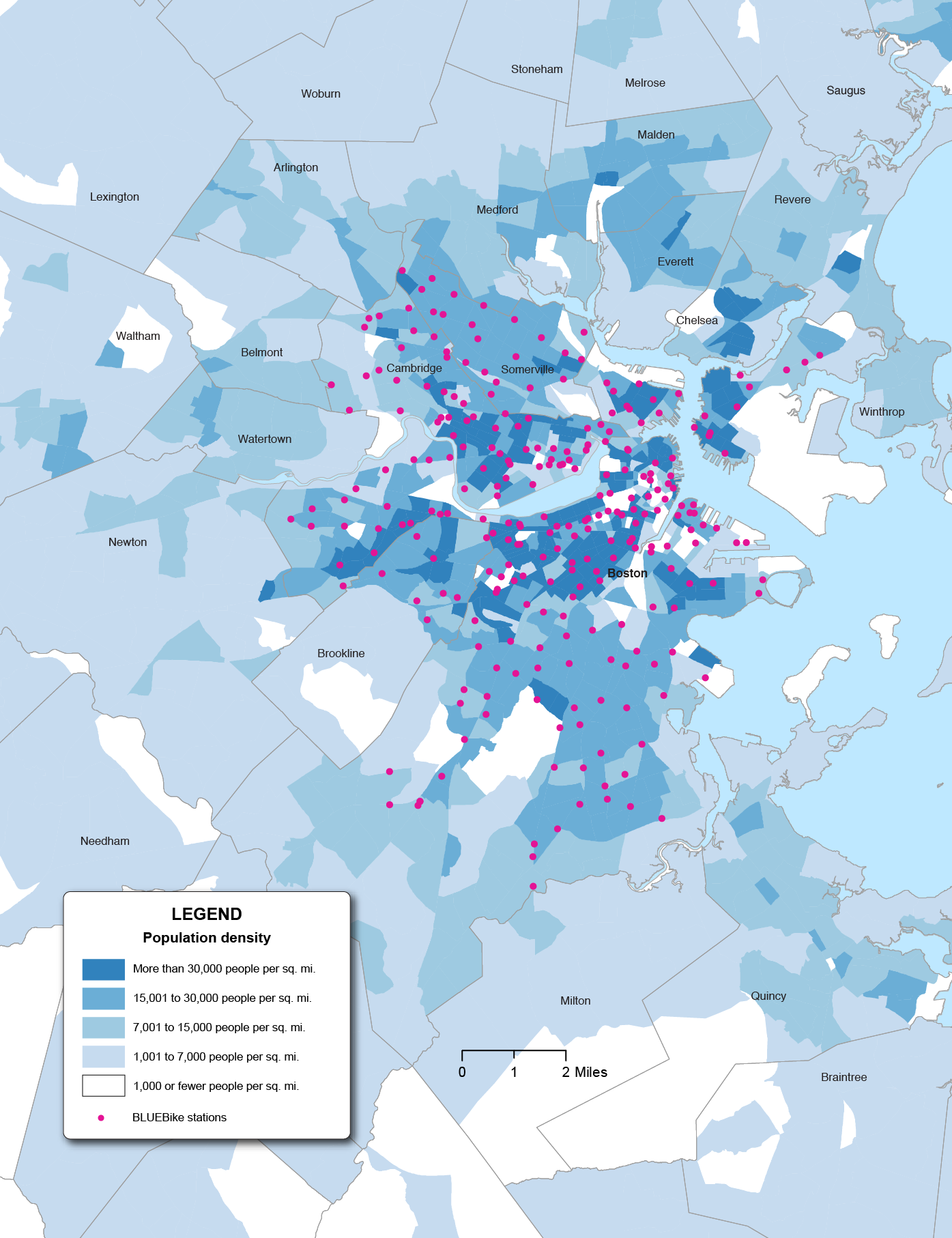

Bicycle and Pedestrian |

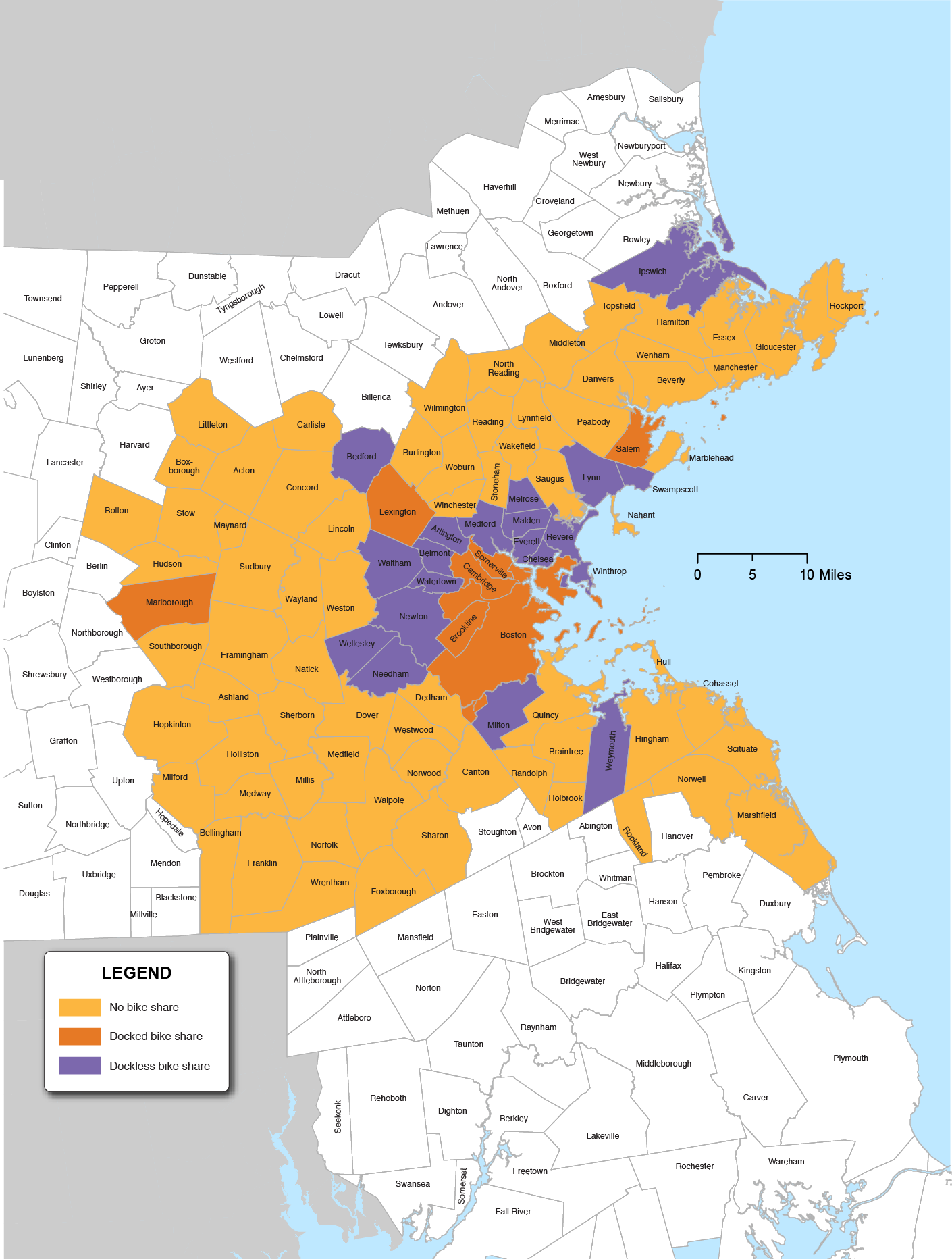

Bike-sharing |

Ensure that docked bike-share facilities are provided in all neighborhoods in the Inner Core, including low-income and minority areas. Monitor the future of dockless bike-share systems. |

Existing Programs Bicycle and Pedestrian Program Bicycle and Pedestrian Support Activities Community Transportation Program |

Bicycle and Pedestrian |

Lack of sidewalk data |

Create a comprehensive inventory of existing sidewalk data, including sidewalk coverage and condition. |

Proposed Study Region-Wide Sidewalk Inventory |

FFY = federal fiscal year. LRTP = Long-Range Transportation Plan. TDM = transportation demand management.

TNC = transportation network company. UPWP = Unified Planning Work Program.

Source: Boston Region MPO.

This section presents the research and analysis MPO staff conducted to understand transportation capacity management and mobility needs in the Boston region for all modes of travel, which have been summarized in the previous section. The following sections present more detailed information on these needs by mode: first is roadway, followed by freight, then transit, and finally, bicycle and pedestrian needs.

Supporting information that the MPO staff used to understand capacity management and mobility needs is included in the Appendices of this Needs Assessment.

This section also provides a summary of input gathered from stakeholders and the public about transportation capacity management and mobility needs, and proposed solutions to meet those needs. Staff considered this input when developing recommendations to achieve the MPO’s Capacity Management and Mobility goals and objectives.

The state of the region’s roadways is perhaps one of the leading indicators of the state of the overall transportation network. As MPO staff’s analysis indicates, congestion on the region’s roadways has increased significantly since the last Needs Assessment, and it is expected to continue to do so over the course of the Destination 2040 LRTP. This congestion and stress affects not only motorists but road users of all modes, including freight operators and bus passengers (detailed sections on freight and bus are included later in the chapter), and significantly impacts both capacity and mobility throughout the region.

A number of different planning processes come together to address capacity management and mobility performance, issues, and needs on the roadway system. Through its Congestion Management Process (CMP), the MPO does extensive analysis of congestion and mobility constraints in the region and produces periodic performance plans that describe other congestion-oriented measures and targets. Along with data from the CMP, the following section describes regional bottleneck locations identified using information from the MPO’s travel demand model; crash data; and staff research on CVs and AVs, shared-use mobility and ride-hailing, car sharing, and travel demand management.

In order to determine how well the region’s roadways are performing with respect to mobility, the MPO applies performance measures that gauge the duration, extent, intensity, and reliability (or regularity) of the occurrence of congestion. MPO staff analyze congestion in the region using its CMP Express Highway and Arterial Performance Dashboards, which apply the following measures2 :

Tables 6-2 and 6-3 show the duration, intensity, and reliability of congestion for the Boston Region MPO’s expressways and arterials, comparing 2012 to 2015 (the most recent data available).

Table 6-2

Regional Performance for Expressways

Expressway |

2012 |

2015 |

AM Average Speed |

57.81 mph |

54.93 mph |

AM Speed Index |

0.99 |

0.95 |

AM Travel Time Index |

1.12 |

1.17 |

PM Average Speed |

58.53 mph |

54.89 mph |

PM Speed Index |

1.01 |

0.95 |

PM Travel Time Index |

1.11 |

1.17 |

Free Flow Speed |

65.28 mph |

64.09 mph |

Average Congested Time per AM Peak-Period Hour |

6 minutes, 49 seconds |

8 minutes, 59 seconds |

Average Congested Time per PM Peak-Period Hour |

5 minutes, 55 seconds |

9 minutes, 9 seconds |

mph = miles per hour.

Source: Boston Region MPO Congestion Management Process.

Table 6-3

Regional Performance for Arterials

Arterials |

2012 |

2015 |

AM Average Speed |

31.57 mph |

28.30 mph |

AM Speed Index |

0.86 |

0.77 |

AM Travel Time Index |

1.09 |

1.30 |

PM Average Speed |

31.92 mph |

27.34 mph |

PM Speed Index |

0.87 |

0.75 |

PM Travel Time Index |

1.07 |

1.35 |

Free Flow Speed |

34.27 mph |

36.87 mph |

Average Congested Time per AM Peak-Period Hour |

2 minutes, 57 seconds |

8 minutes, 57 seconds |

Average Congested Time per PM Peak-Period Hour |

2 minutes, 20 seconds |

11 minutes,10 seconds |

mph = miles per hour.

Source: Boston Region MPO Congestion Management Process.

As shown above, congestion has increased across the region’s roadways. Average travel times at peak have increased and average speeds decreased on both freeways and arterials. Of particular note is the marked increase—a tripling or quadrupling—in both AM and PM peak congestion time experienced by travelers on arterials. This is a special concern because, in addition to drivers, it also affects bus passengers (see analysis of the effects of the slowing of arterial traffic on buses below).

MPO staff established congestion thresholds for the region’s express highways and arterial roadways based on travel time index (TTI), which is the average peak-period travel time divided by free-flow travel time. When the average peak-period travel time equals free-flow travel time, the index equals one; higher values indicate more congestion. The MPO’s TTI-based congestion thresholds are:

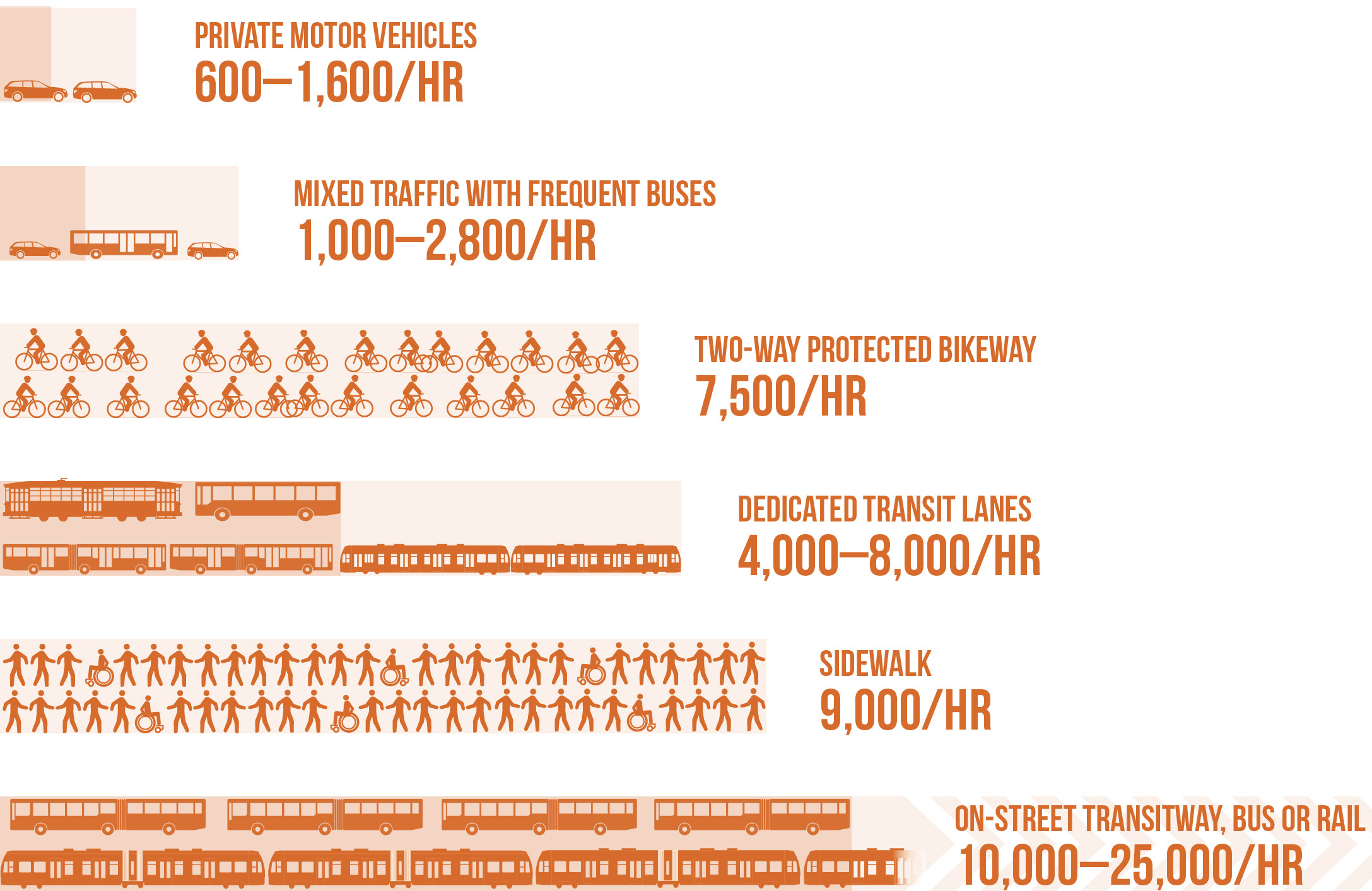

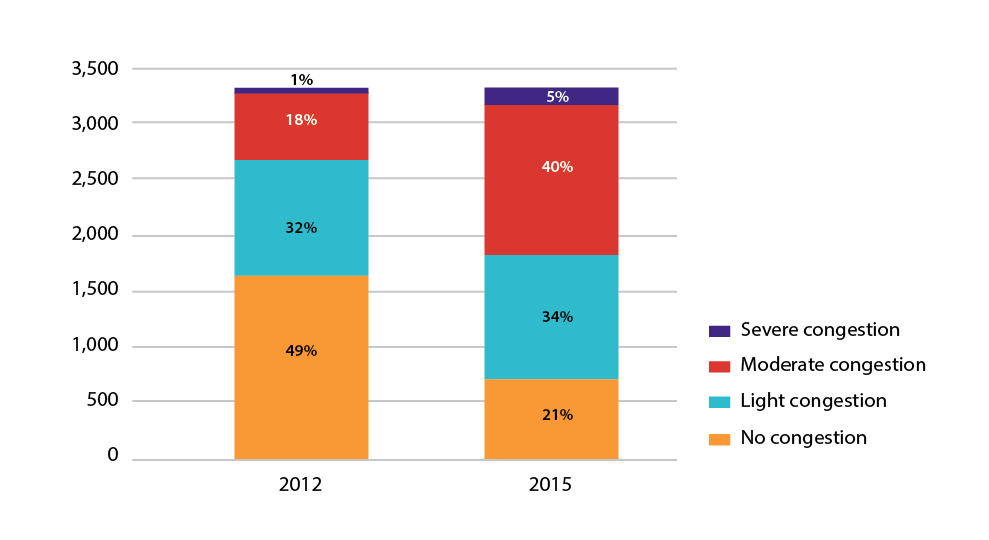

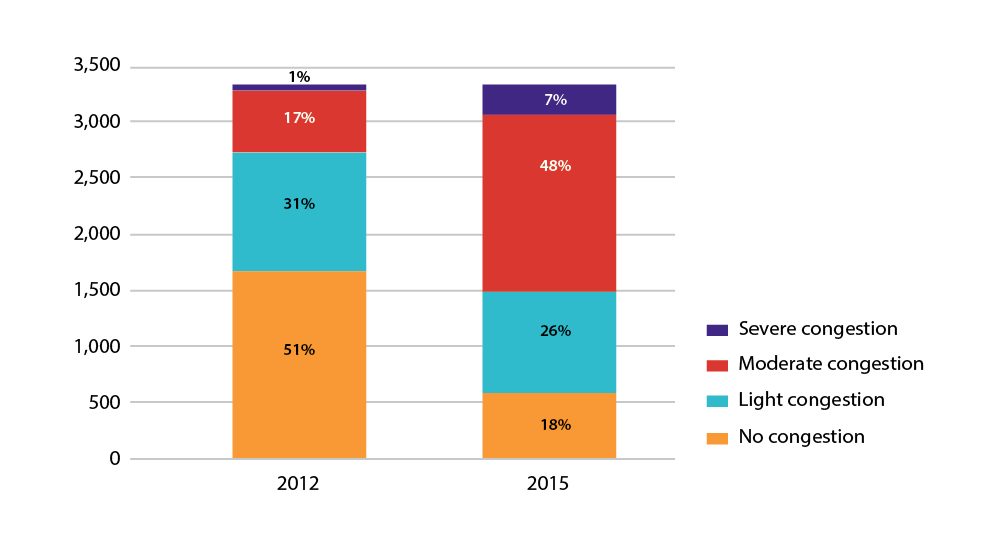

The Boston Region MPO obtains speed and travel time data to understand how congestion is changing on the region’s express highways and arterial roadways. Figures 6-2 through 6-5 compare congestion levels based on data from 2012 to data from 2015. Each figure reflects a different combination of roadway type (expressway or arterial) and the time of day (AM or PM peak period). The figures also show both the total lane miles experiencing each level of congestion and the percent of CMP monitored roadways experiencing each level of congestion.

Figure 6-2

Lane Miles of Congestion on CMP Monitored Expressways in the AM Peak Period,

2012 and 2015

Note: This chart displays data for the 97 municipalities in the Boston Region MPO area. The AM peak-period time window for expressways is: 6:00 AM to 10:00 AM.

CMP = congestion management process.

Source: Boston Region MPO Congestion Management Process, 2012 and 2015 INRIX data.

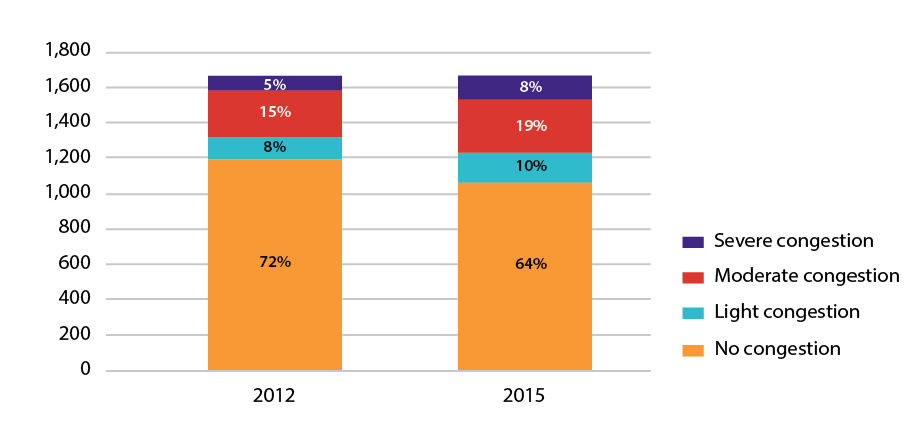

Figure 6-3

Lane Miles of Congestion on CMP Monitored Expressways in the PM Peak Period,

2012 and 2015

Note: This chart displays data for the 97 municipalities in the Boston Region MPO area. The PM peak-period time window for expressways is 3:00 PM to 7:00 PM.

CMP = congestion management process.

Source: Boston Region MPO Congestion Management Process, 2012 and 2015 INRIX data.

Figures 6-2 and 6-3 show that congestion is getting worse on the region’s expressways. While 28 percent of CMP-monitored express highways experienced some congestion during the AM peak period in 2012, this share increased to 37 percent in 2015. The number of lane miles experiencing moderate congestion increased by 53 lane-miles (21 percent) between these two time periods, while the number of lane miles experiencing severe congestion increased by approximately 47 lane miles (60 percent). During the PM peak-period, 30 percent of monitored expressways experienced some level of congestion in 2012 and by 2015, this increased to 41 percent. The number of lane miles experiencing moderate congestion increased by 97 lane miles (33 percent), while the number of lane miles experiencing severe congestion increased by 83 lane miles (258 percent).

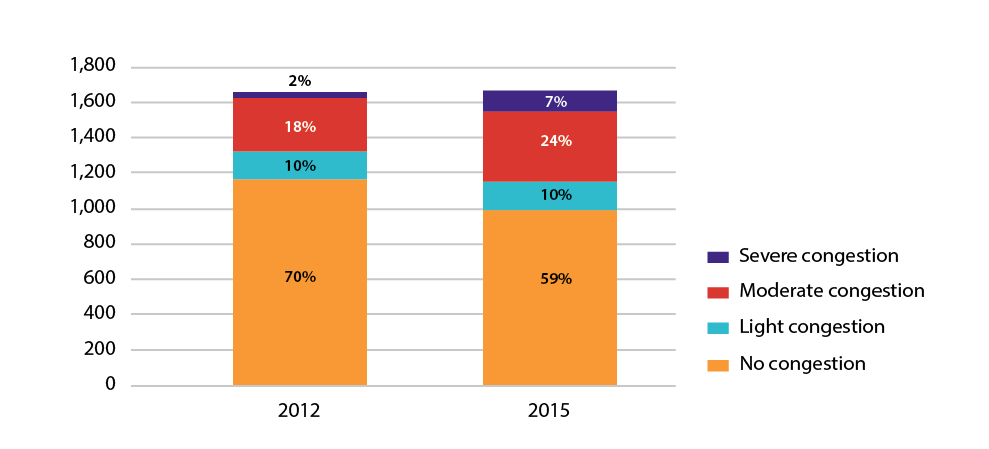

Figure 6-4

Lane Miles of Congestion on CMP Monitored Arterial Roadways in the AM Peak Period, 2012 and 2015

Note: This chart displays data for the 97 municipalities in the Boston Region MPO area. The AM peak-period time window for arterial roadways is 6:30 AM to 9:30 AM.

CMP = congestion management process.

Source: Boston Region MPO Congestion Management Process, 2012 and 2015 INRIX data.

Figure 6-5

Lane Miles of Congestion on CMP Monitored Arterial Roadways in the PM Peak Period, 2012 and 2015

Note: This chart displays data for the 97 municipalities in the Boston Region MPO area. The PM peak-period time window for arterial roadways is 3:30 PM to 6:30 PM.

CMP = congestion management process.

Source: Boston Region MPO Congestion Management Process, 2012 and 2015 INRIX data.

Figures 6-4 and 6-5 show that congestion was worse on arterial roadways than on expressways, even in 2012, and that congestion has also gotten worse based on 2015 data. In the AM peak period, 51 percent of arterial roadways experienced congestion of some kind in 2012—this increased to 79 percent in 2015. The number of lane miles experiencing moderate congestion increased by approximately 742 lane miles (124 percent) between these two time periods, while the number of lane miles experiencing severe congestion increased by approximately 117 lane miles (287 percent). During the PM peak period, 49 percent of monitored expressways experienced some level of congestion in 2012—by 2015, this increased to 81 percent. The number of lane miles experiencing moderate congestion increased to 1,016 lane miles (179 percent), while the number of lane miles experiencing severe congestion increased by 224 lane miles (more than 1000 percent).

The increase in congestion in the MPO region could have numerous causes, among them the growing economy and population, the popularity of TNCs, displacement of workers to outer suburbs in search of affordable housing, and the customer-facing cost of driving being low—relative to the cost of using public transit. More work will be needed during the duration of Destination 2040 to fully understand the causes and consequences of this congestion.

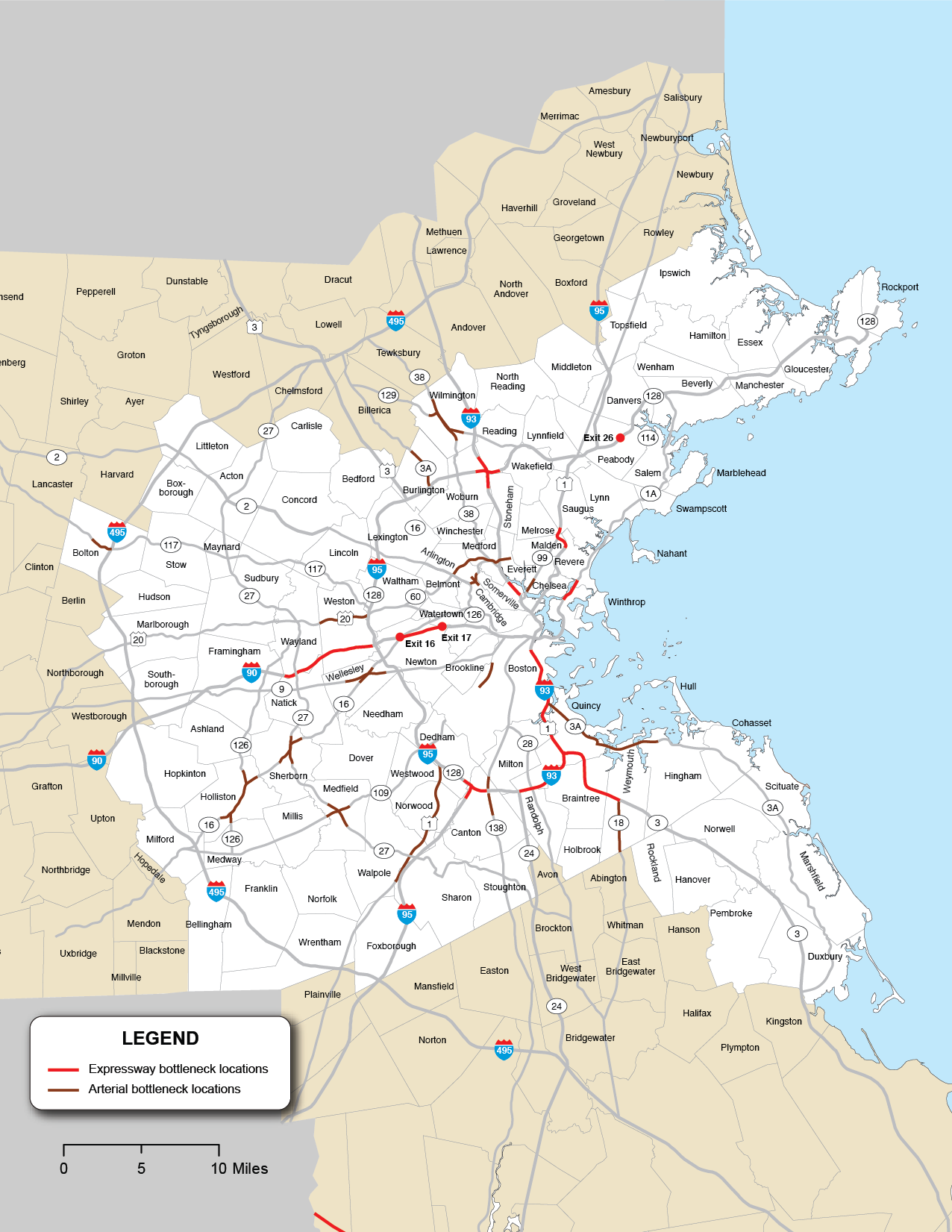

The MPO has identified a priority set of congested locations on the region’s express highways and arterials. These locations are shown in Table 6-4 and Figure 6-6, respectively. To identify the bottleneck locations, three measures were selected from various datasets for segments of the region’s road network. The measures include:

The information used to establish traffic bottlenecks is more advanced than what was used for the previous LRTP, Charting Progress to 2040. As a consequence of this improved data, the priority locations listed in Table 6-4 and Figure 6-6 focus more closely on the specific locations causing or exacerbating regional congestion. This new approach is illustrated in Table 6-4 with a column that shows how each congested location identified now compares to the assessment of the same location in the previous LRTP. Many locations are shown as shorter segments now, focusing on perhaps one or two especially problematic intersections and nearby roadways. Other problem locations are the same as before, larger, or in some cases, newly identified as priority locations. The MPO uses the data developed here to select locations for study through the UPWP, as well as to develop regional priorities for funding through the TIP. MPO activities and investments that increase the reliability of the roadway network benefit both light and heavy vehicles such as trucks and buses.

Table 6-4

Priority Bottleneck Locations

| Municipality |

Routes |

Expressway Feature |

Comparison with Previous LRTP |

Number of HSIP Clusters |

EPDO |

Recent Study |

|---|---|---|---|---|---|---|

Malden |

US 1 |

Quarry bypass |

shorter |

2 |

325 |

MassDOT Project # 605012 - Route 1 Reconstruction and Widening: Preliminary Design |

Boston |

1A |

Boardman Street flyover |

new |

na |

na |

none |

Peabody |

128 |

Exit 26 |

same |

3 |

185 |

none |

Woburn |

I-93/I-95 |

Interchange |

shorter |

7 |

1,292 |

none |

Everett |

99-CUFC |

|

shorter |

3 |

181 |

2016: RSA: Broadway between Dexter Street and Beacham Street 2016: RSA: Santilli Circle and Sweetser Circle |

Medford |

60 |

|

longer |

4 |

290 |

2018: CTPS: Priority Roadways - Medford Square |

Burlington |

3A |

|

new |

2 |

122 |

none |

Wilmington |

38/129 |

|

shorter |

3 |

183 |

2012: CTPS: Safety and Operations Analysis at Selected Intersections: Main Street at Church Street and Burlington Avenue |

Somerville |

I-93 |

Embankment |

shorter |

4 |

633 |

none |

Cambridge |

2A/16 |

|

shorter |

4 |

212 |

2009: CTPS: Alewife Studies, Phases One and Two |

Arlington |

2A/16 |

|

new |

na |

na |

2009: CTPS: Alewife Studies, Phases One and Two |

Arlington |

60 |

|

longer |

2 |

126 |

none |

Bolton |

117 |

|

new |

3 |

145 |

2011: CTPS: Safety and Operations Analyses at Selected Boston Region MPO Intersections: Main Street (Route 117) at Still River Road (Route 110) |

Newton |

I-90 |

Exits 16–17 |

same |

5 |

395 |

2006: CTPS: I-90 Interchange 17 (Newton Corner): Traffic Patterns and Operational and Safety Improvements

2009: CTPS: Newton Corner Rotary Study: Phase Two |

Weston |

I-90 |

Exits 13–14 |

new |

4 |

485 |

2011: CTPS: Low-Cost Improvements to Express-Highway Bottleneck Locations: I-95 northbound, ramp merge area at interchange 24 in Weston

2015: CTPS: Low-Cost Improvements to Express-Highway Bottleneck Locations: I-95 southbound at the I-90 Interchange in Weston |

Natick |

I-90 |

Exits 13–14 |

new |

2 |

97 |

none |

Weston |

US 20 |

|

same |

3 |

211 |

2011: CTPS: Weston Community Transportation Technical Assistance: Boston Post Road, Church Street, and School Street Intersection |

Wellesley |

16/9 |

|

shorter |

6 |

350 |

none |

Sherborn |

16/27 |

|

shorter |

na |

na |

none |

Holliston |

16/126 |

|

shorter |

2 |

107 |

2012: RSA: Washington Street |

Canton |

I-93/I-95 |

Interchange |

new |

5 |

356 |

2013: I-95 Northbound Off-Ramp to I-93 Northbound—Construction Completed

2015: Canton Street/University Avenue Intersection—Construction Completed

2016: University Avenue Off Ramp—Construction Completed

2016: Dedham Street—Ongoing On-Hold (I-95/I-93 Interchange: 25% Design) |

Boston |

DCR |

|

new |

3 |

244 |

none |

Canton |

138 |

|

shorter |

4 |

354 |

2016: RSA: Route 138 at Randolph Street

2017: CTPS: Route 138 Priority Corridor Study |

Westwood |

US 1 |

|

same |

1 |

62 |

none |

Norwood |

US 1 |

|

same |

3 |

176 |

2014: RSA: Neponset Street Rotary/Pendergast Rotary

2017: RSA: Providence Highway (Route 1) at Morse Street

2014: Route 1 at Everett Street and University Avenue |

Walpole |

US 1 |

|

same |

4 |

234 |

2017: Providence Highway (Route 1) at Coney Street 2013 - Providence Highway (Route 1) at High Plain Street (Route 27) |

Medfield |

109/27 |

|

new |

na |

na |

2008: CTPS: Safety and Operations Analysis at Selected Intersections: Route 109 at Route 27 |

Boston |

I-93 |

Southeast Expressway |

same |

9 |

2,267 |

2012: CTPS: Improving the Southeast Expressway—A Conceptual Plan |

Milton |

I-93 |

Southeast Expressway |

same |

3 |

745 |

2012: CTPS: Improving the Southeast Expressway—A Conceptual Plan |

Quincy |

I-93 |

Southeast Expressway |

same |

4 |

1,062 |

2012: CTPS: Improving the Southeast Expressway—A Conceptual Plan

2006: CTPS: I-93/Southeast Expressway/Route 3 (Braintree Split)—Operational Assessment and Potential Improvements |

Braintree |

I-93 |

Southeast Expressway approach |

new |

4 |

734 |

2006: CTPS: I-93/Southeast Expressway/Route 3 (Braintree Split)—Operational Assessment and Potential Improvements |

Randolph |

I-93 |

Southeast Expressway approach |

new |

4 |

265 |

2006: CTPS: I-93/Southeast Expressway/Route 3 (Braintree Split)—Operational Assessment and Potential Improvements |

Braintree |

3 |

Southeast Expressway approach |

new |

4 |

386 |

2006: CTPS: I-93/Southeast Expressway/Route 3 (Braintree Split)—Operational Assessment and Potential Improvements |

Weymouth |

3 |

Southeast Expressway approach |

new |

2 |

138 |

2016: RSA: Route 3 |

Quincy |

3A |

|

same |

10 |

778 |

2012: CTPS: FFY 2012 Safety and Operations Analyses at Selected Boston Region MPO Intersections: Southern Artery (Route 3A) at Sea Street/Coddington Street and at McGrath Highway/Field Street |

Weymouth |

3A |

|

same |

1 |

85 |

2016: RSA: Route 3A from Evans Street to Abigail Adams State Park |

Hingham |

3A |

|

shorter |

na |

na |

2016: CTPS: Summer Street/George Washington Boulevard Subregional Priority Roadway Study in Hingham and Hull |

Weymouth |

18 |

|

same |

9 |

884 |

2011: RSA: Route 18 at Various Locations |

Braintree |

37-CUFC |

|

new |

5 |

425 |

2014: CTPS: Safety and Operations Analyses at Selected Intersections: FFY 2013: Franklin Street (Route 37) at West Street and Granite Street |

Note: The Central Transportation Planning Staff (CTPS) is the staff to the Boston Region MPO. In addition to its work with the Boston Region MPO, CTPS works with and conducts studies for other transportation agencies in the state.

CTPS = Central Transportation Planning Staff. CUFC = Critical Urban Freight Corridor. DCR = Department of Conservation and Recreation. EPDO = Equivalent Property Damage Only. HSIP = Highway Safety Improvement Program. MassDOT = Massachusetts Department of Transportation. na = none available. RSA = roadway safety audit.

Source: Boston Region MPO.

Figure 6-6

Priority Bottleneck Locations

Source: Boston Region MPO.

In addition to the performance measures tracked as part of the MPO’s CMP, described in the “Changes in Traffic Congestion” section above, the MPO is required to establish specific performance targets for federally required performance measures for travel reliability on the National Highway System (NHS) in the Boston region. These measures include

These target measures capture whether travel times on an NHS segment are consistent (reliability), and the extent to which NHS users’ travel may be affected by those conditions (percent of person-miles). Information on the development of these targets is described in more detail in the Destination 2040 LRTP chapter on performance.

Both states and MPOs are required to set two-year and four-year targets for these measures. In 2018, the Massachusetts Department of Transportation (MassDOT) calculated baselines and established targets for these measures for the Massachusetts Interstate and non-Interstate NHS networks. Table 6-5 shows MassDOT’s calendar year (CY) 2017 baselines and two-year and four-year targets for these measures. The Boston Region MPO (like all MPOs) was also required to establish four-year targets for these measures by either supporting state targets or setting its own quantitative targets for the MPO region. In 2018, the MPO voted to support the state’s four-year targets. Table 6-5 also shows CY 2017 baselines for the Boston region’s Interstate and non-Interstate NHS networks as a basis for comparison. As the table shows, Boston’s share of reliable person-miles traveled on its Interstate and non-Interstate NHS networks is lower than those values for Massachusetts as a whole.

Table 6-5

Travel Time Reliability Performance Measure Baselines and MassDOT Performance Targets

Network |

Measure |

Cumulative Traffic |

2017 Measure |

Two-Year Target |

Four-Year Target |

Massachusetts—Interstate Highway System |

Percent of person-miles on the Interstate Highway System that are reliable |

1,150 |

68.0% |

68.0% |

68.0% |

Massachusetts—Non-Interstate NHS System |

Percent of person-miles on the non-Interstate NHS that are reliable |

5,257 |

80.0% |

80.0% |

80.0% |

Boston Region—Interstate Highway System |

Percent of person-miles on the Interstate Highway System that are reliable |

354 |

47.2% |

na |

See Massachusetts Target |

Boston Region—Non-Interstate NHS System |

Percent of person-miles on the non-Interstate NHS that are reliable |

1,799 |

69.0% |

na |

See Massachusetts Target |

aThe two-year target reflects conditions as of the end of CY 2019, and the four-year target reflects conditions as of the end of CY 2021.

CY = calendar year. MassDOT = Massachusetts Department of Transportation. NHS = National Highway System. na = not applicable

Sources: National Performance Management Research Data Set, Cambridge Systematics, MassDOT, and the Boston Region MPO.

MassDOT and the Boston Region MPO also monitor traffic congestion to meet Congestion Mitigation and Air Quality Improvement (CMAQ) program requirements. The performance measures employed are designed to help states, the Federal Highway Administration (FHWA), and MPOs better understand the impacts of CMAQ investments, which are intended to contribute to air quality improvements and provide congestion relief.

CMAQ traffic congestion-related performance measures apply to urbanized areas that contain geographic locations designated as nonattainment areas or maintenance areas by the United States Environmental Protection Agency (EPA). A nonattainment area does not meet National Ambient Air Quality Standards (NAAQS) for monitored air pollutants; a maintenance area is one with a history of nonattainment that now meets the standards and where air quality continues to be monitored. The EPA monitors common air pollutants, known as criteria pollutants, including carbon monoxide, nitrogen dioxide, ozone, particulate matter, sulfur dioxide, and precursors from mobile sources.3

States must be involved in setting targets for these measures if 1) they have mainline highways on the NHS that cross part of an urbanized area (UZA) with a population of more than one million; and 2) that UZA contains part of a nonattainment or maintenance area for relevant criteria pollutants. Similarly, MPOs must participate in target setting for the traffic congestion measures if they

Massachusetts and the Boston Region MPO each meet these respective criteria and must be involved in monitoring and setting targets for traffic congestion performance measures for the Boston UZA, which contains or overlaps several MPO areas in eastern Massachusetts, New Hampshire, and Rhode Island.

The first of these CMAQ traffic congestion measures is annual hours of peak hour excessive delay (PHED) per capita, which estimates the excessive delays experienced by a UZA’s population from travel on the NHS during peak-periods. Information on the development of PHED per capita targets is described in more detail in the Destination 2040 LRTP chapter on performance.

To understand baseline performance and set targets for this measure, MassDOT and the New Hampshire Department of Transportation (NH DOT) worked with analysts at Cambridge Systematics. Using 2017 data, MassDOT and NH DOT calculated annual hours of PHED for travel on the NHS in their respective portions of the Boston UZA.4 In 2018, the agencies in the Boston UZA that are subject to CMAQ performance monitoring requirements—MassDOT, NH DOT, the Boston Region MPO, and the Northern Middlesex Council of Governments (NMCOG)—established two-year and four-year targets that maintain this 2017 baseline value for the annual hours of PHED per capita measure, as shown in Table 6-6.

Table 6-6

Baseline Value and Performance Targets for Annual Hours of Peak Hour Excessive Delay Per Capita for the Boston UZA

Geographic Area |

Massachusetts and New |

Boston UZA Population (MA and NH only)a |

2017 Measure Value (Baseline) |

Two-Year Target |

Four-Year Target |

Boston Urbanized Area |

80,053,183 |

4,371,476 |

18.30 |

18.30 |

18.30 |

a Cambridge Systematics aggregated 2012–16 American Community Survey population estimates at the block group level to estimate the population for the portion of the UZA in Massachusetts and New Hampshire. Cambridge Systematics then inflated this estimate for 2017 by applying information on expected population growth in the Boston Metropolitan Statistical area between 2016 and 2017.

CY =calendar year. MA = Massachusetts. NH = New Hampshire. PHED = peak hours of excessive delay. UZA = urbanized area.

Sources: National Performance Management Research Data Set, US Census, FHWA, MassDOT, the New Hampshire Department of Transportation, and Cambridge Systematics.

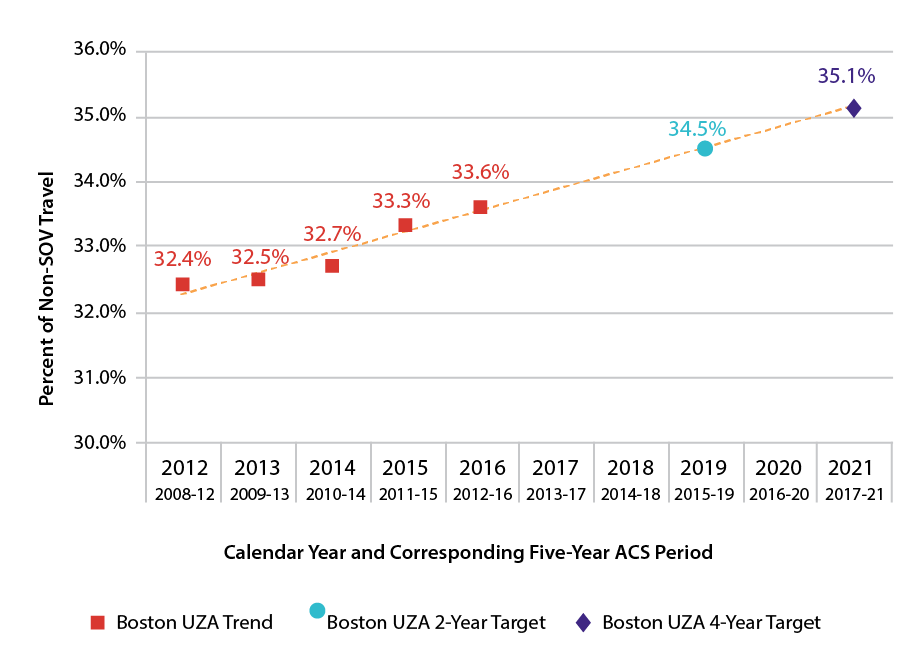

States and MPOs that meet applicability criteria for CMAQ performance requirements must also monitor and set targets for the share of non-single occupant vehicle (non-SOV) travel in the Boston region. Agencies calculate this measure at the UZA level. The percent of non-SOV travel performance measure describes the extent to which people are using alternatives to single-occupant vehicles (SOVs), as greater use of alternative SOVs may help reduce traffic congestion and air pollution from motor vehicles.

Collectively, MassDOT, NH DOT, the Boston Region MPO, and NMCOG used the US Census Bureau’s American Community Survey (ACS) data5 to estimate the percent of workers age 16 and older who commuted to work using an option other than driving alone.6 Figure 6-7 shows how the percentage of workers using non-SOV commuting options in the Boston UZA has increased between 2012 (2008–12 ACS estimate) and 2016 (2012–16 ACS estimate). MassDOT calculated a linear trend line using these values for the Boston UZA and used that trend line to project expected values as of the end of CY 2019 (the expected 2015–19 ACS estimate) and CY 2021 (the expected 2017–21 ACS estimate). These agencies established these projected values as the Boston UZA targets for the percent of non-SOV travel. Table 6-7 also lists the recent baseline and performance target for this measure.

Figure 6-7

Historic Values and Performance Targets for the Percent of

Non-SOV Travel in the Boston UZA

ACS = US American Community Survey. SOV = single-occupancy vehicle. UZA = urbanized area.

Sources: US Census Bureau, 2012–16 American Community Survey Five-Year Estimates; MassDOT; and NH DOT.

Table 6-7

Baseline Value and Performance Targets for Percent of

Non-SOV Travel for the Boston UZA

Geographic Area |

2017 Measure Value (Baseline) |

Two-Year Target |

Four-Year Target |

Boston UZA |

33.6% |

34.5% |

35.1% |

ACS = American Community Survey. CY = calendar year. SOV = single-occupancy vehicle. UZA = urbanized area.

Sources: MassDOT, NH DOT, and ACS.

The MPO and its staff will continue to monitor the implementation of CV and AV technology in the Boston region. It is commonly thought that the adoption of CV and AV technology will result in significant capacity gains on roadway networks, but the timeline for adoption of this technology and its feasibility, remains highly uncertain, as do the second-order effects of any such boosts in capacity. The MPO has initiated its planning efforts through the report Connected and Autonomous Vehicles and the Boston MPO—A First Look, presented in 2018. This report chronicles the development of CV and AV technology up to the point of its publishing and recommends a number of planning and policy actions that the MPO can take to maintain a flexible, proactive stance toward CV and AV development and implementation. MPO staff have since made progress on incorporating CV and AV planning into ongoing MPO programs, and staff continue to familiarize themselves on CV and AV issues, since CV and AV planning could potentially play a role in future scenario planning.

TheCommission on the Future of Transportation in the Commonwealth report, Choices for Stewardship: Recommendations to Meet the Transportation Future includes a recommendation to develop a strategy to support CVs and AVs. The MPO will coordinate with MassDOT to help implement this recommendation.

One of the biggest developments in the transportation planning world since the MPO’s last LRTP has been the rapid growth of shared-used and for-hire car services, more commonly known as ridesourcing, ridesharing, and ride-hailing, among other terms. TNCs, such as Uber and Lyft, are the highest profile segment of the shared-use transportation field. This is a rapidly evolving industry, and it has already had a significant impact on transportation, however, the impact on existing transportation networks and on the future of transportation still remains unclear. MPO staff has documented the region’s shared-use options through the March 2017 report, Shared-Use Mobility Options—Literature Review.7 In a demonstration of the volatility of the field, several of the companies that were featured in the report have since gone out of business in Boston.

Public research and policy concern has largely focused on the highest-profile subsector of the shared-use field—TNCs. The State of Massachusetts Department of Public Utilities has begun collecting data on ridesharing/ride-hailing trips. The data is presented in Tables 6-8 and 6-9.8 Table 6-8 shows the estimated person trips and ride-hailing activity for municipalities in the Inner Core area, where the vast majority of TNC trips in the region are taken. Boston and Cambridge have the largest number of trips and ridesharing activity with Somerville and Brookline following closely behind.

Table 6-8

Estimated Person Trips and Ride-Hailing Activity for Inner Core Subregion Municipalities

Municipality |

Trips Started Per Person |

Annual Trips |

Annual Trips |

Ride-hailing Trips |

Ride-hailing Trips |

Boston |

57 |

967,288,818 |

895,499,530 |

34,911,476 |

35,221,885 |

Cambridge |

64 |

189,847,847 |

179,109,006 |

6,782,366 |

6,454,440 |

Somerville |

36 |

87,268,870 |

88,633,826 |

2,727,951 |

2,637,115 |

Brookline |

35 |

70,797,608 |

76,026,259 |

2,074,425 |

1,963,570 |

Chelsea |

19 |

43,285,073 |

42,986,266 |

656,686 |

632,627 |

Medford |

17 |

66,409,699 |

67,903,947 |

966,710 |

966,364 |

Malden |

15 |

62,232,358 |

64,944,230 |

906,043 |

867,169 |

Revere |

14 |

54,481,061 |

57,125,847 |

722,136 |

714,901 |

Everett |

19 |

61,619,596 |

56,293,077 |

775,773 |

753,268 |

Watertown |

15 |

47,959,601 |

46,679,180 |

469,122 |

480,161 |

Newton |

12 |

122,452,446 |

125,034,672 |

1,051,030 |

1,073,900 |

Quincy |

10 |

118,837,779 |

116,245,809 |

957,311 |

963,069 |

Waltham |

12 |

102,810,459 |

94,488,201 |

711,420 |

723,227 |

Belmont |

8 |

29,546,032 |

30,494,233 |

195,807 |

201,636 |

Winthrop |

6 |

16,736,781 |

17,819,225 |

103,750 |

103,862 |

Arlington |

6 |

47,519,338 |

50,888,290 |

258,133 |

273,416 |

Lynn |

6 |

106,210,599 |

104,907,612 |

549,822 |

511,532 |

Milton |

5 |

29,705,413 |

33,198,745 |

138,761 |

142,492 |

Melrose |

5 |

30,007,776 |

31,644,455 |

129,355 |

143,475 |

Saugus |

6 |

40,654,204 |

39,434,253 |

147,714 |

162,887 |

Source: Data in this table courtesy of the Metropolitan Area Planning Council, originally published in Share of Choices report.

The Metropolitan Area Planning Council (MAPC) has also published two reports on the topic of ride-hailing: Fare Choices9 (February 2018) and Share of Choices10 (May 2018). The Fare Choices study collected data on trip origins and destinations, demographics, and transportation options through an in-vehicle survey of ride-hailing users, finding that ride-hailing users skew young (two-thirds of survey respondents were between 22 and 34 years old) but resemble the region at large in terms of income. Similar to the CTPS literature review,11 the Fare Choice report also raised questions about whether ride-hailing trips are replacing trips made by more sustainable modes, and if that is diverting financial resources from providers such as the Massachusetts Bay Transportation Authority (MBTA). The Share of Choices report used newly collected state-level data and modeling to estimate that one ride-hailing trip is taken for every five transit trips in the Inner Core, as shown in Table 6-9. It also notes that this dynamic may have cost the MBTA upwards of $19.3 million in 2017.

Table 6-9

Estimated Mode Shares of Ride-Hailing Activity and Public Transit for Inner Core Subregion Municipalities

Municipality |

Ride-hailing |

Public transit |

Ratio |

Ride-hailing |

Public transit |

Ratio |

Somerville |

3.13% |

8.27% |

0.38 |

2.98% |

8.18% |

0.36 |

Everett |

1.26% |

3.47% |

0.36 |

1.34% |

3.81% |

0.35 |

Cambridge |

3.57% |

12.65% |

0.28 |

3.60% |

13.31% |

0.27 |

Chelsea |

1.52% |

5.98% |

0.25 |

1.47% |

5.95% |

0.25 |

Medford |

1.46% |

5.80% |

0.25 |

1.42% |

5.66% |

0.25 |

Brookline |

2.93% |

13.06% |

0.22 |

2.58% |

12.21% |

0.21 |

Malden |

1.46% |

6.59% |

0.22 |

1.34% |

6.31% |

0.21 |

Boston |

3.61% |

18.19% |

0.20 |

3.93% |

19.54% |

0.20 |

Winthrop |

0.62% |

3.47% |

0.18 |

0.58% |

3.24% |

0.18 |

Arlington |

0.54% |

3.12% |

0.17 |

0.54% |

3.01% |

0.18 |

Watertown |

0.98% |

5.65% |

0.17 |

1.03% |

5.82% |

0.18 |

Waltham |

0.69% |

4.24% |

0.16 |

0.77% |

4.60% |

0.17 |

Melrose |

0.43% |

2.68% |

0.16 |

0.45% |

2.56% |

0.18 |

Revere |

1.33% |

8.80% |

0.15 |

1.25% |

8.44% |

0.15 |

Quincy |

0.81% |

5.57% |

0.14 |

0.83% |

5.68% |

0.15 |

Newton |

0.86% |

6.41% |

0.13 |

0.86% |

6.29% |

0.14 |

Belmont |

0.66% |

5.17% |

0.13 |

0.66% |

5.00% |

0.13 |

Milton |

0.47% |

3.80% |

0.12 |

0.43% |

3.44% |

0.12 |

Saugus |

0.36% |

3.45% |

0.11 |

0.41% |

3.61% |

0.11 |

Lynn |

0.52% |

7.66% |

0.07 |

0.49% |

7.77% |

0.06 |

Inner Core |

2.41% |

11.78% |

0.20 |

2.48% |

12.14% |

0.20 |

Source: Table courtesy of the Metropolitan Area Planning Council, originally published in Share of Choices report.

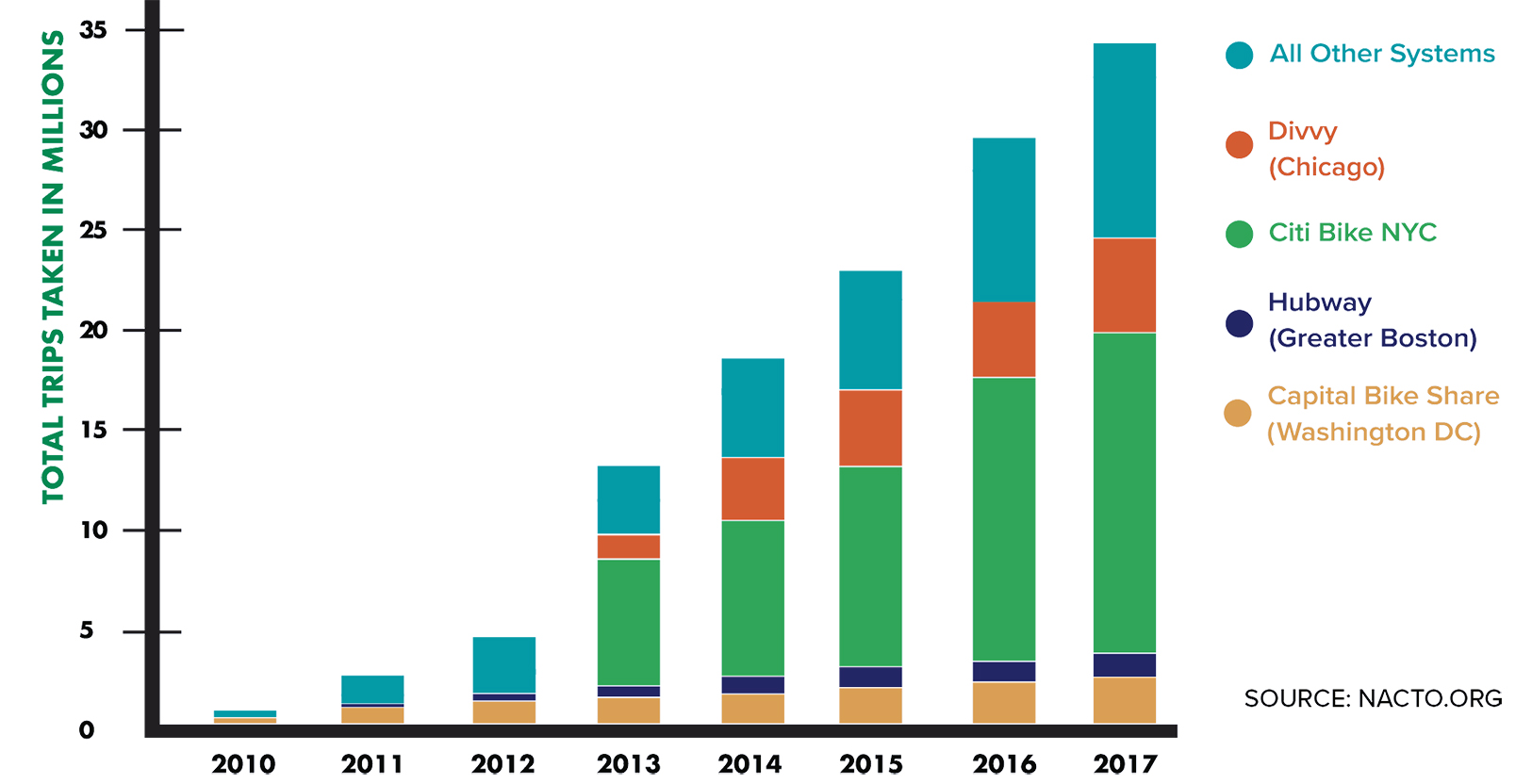

The growth in the field raises serious questions of how MPO and broader public policy should relate to shared-use services. While bike-sharing likely complements the MPO’s goals of promoting growth in demand for nonautomotive travel options and mode shift, the effect of TNCs, car sharing and the like, is less certain.

As the MPO literature review documents state, there are serious equity-based concerns about access for people without bank accounts and/or smartphones; and disparities in service availability and accessibility for individuals with disabilities. Ride-hailing may also divert financial resources from public sector transportation providers and contribute to congestion on the region’s roadways. MAPC’s Fare Choices report estimated that “15 percent of all ride-hailing trips replaced a more sustainable mode during the morning and afternoon commutes.” Although experiments are ongoing around the country, such services remain largely unintegrated with other modes of transit.

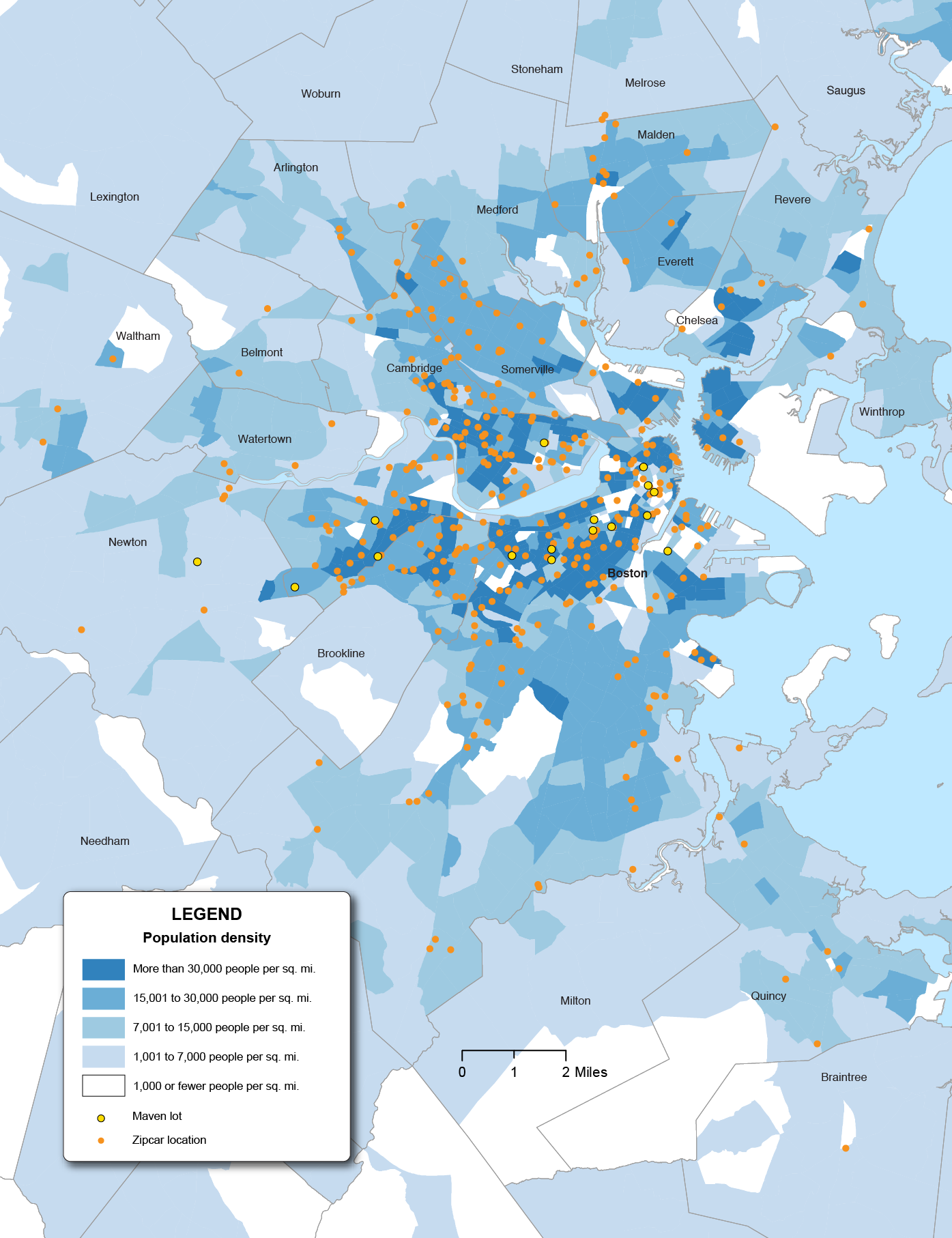

Car sharing provides an alternative to both ride-hailing and traditional car ownership—users rent cars by the hour from a provider, but with more flexibility and automation than a traditional car rental business. Cars are physically located throughout communities rather than concentrated at a company facility. The dominant car sharing company in the Boston region is Zipcar. General Motors’ Maven also has a small presence in the Inner Core, while Enterprise Car Share wound down its Boston-area operations in 2017. Like ride-hailing, the impact of car sharing and its role in future policy is an open question subject to further study. Table 6-10 provides information on the accessibility of jobs and housing to car sharing in the Inner Core of the MPO region (where the majority of car sharing locations are found) while Figure 6-8 shows the locations overlaid by population density. Although there are not as many car sharing locations, there are locations outside of the Inner Core in municipalities including Beverly, Framingham, Lynn, Salem, Wellesley, and Wenham.

Table 6-10

Access to Car Sharing in the Boston Region

Car Share |

Employment |

Percent of Employment |

Households |

Percent of Households |

Population |

Percent of Population |

Inner Core |

1,006,000 |

|

616,800 |

|

1,487,900 |

|

Within 1/4 mile |

665,900 |

66% |

287,300 |

47% |

676,300 |

45% |

Within 1/2 mile |

814,200 |

81% |

422,300 |

68% |

1,011,000 |

68% |

Regional Urban Centers |

307,700 |

|

234,200 |

|

566,200 |

|

Within 1/4 mile |

19,900 |

6% |

10,300 |

4% |

23,200 |

4% |

Within 1/2 mile |

42,000 |

14% |

30,200 |

13% |

69,500 |

12% |

Maturing Suburbs |

470,200 |

|

339,800 |

|

871,900 |

|

Within 1/4 mile |

1,700 |

< 1% |

800 |

< 1% |

3,400 |

< 1% |

Within 1/2 mile |

5,800 |

1% |

4,000 |

1% |

12,700 |

1% |

Developing Suburbs |

139,700 |

|

121,200 |

|

319,900 |

|

Within 1/4 mile |

90 |

< 1% |

20 |

< 1% |

240 |

< 1% |

Within 1/2 mile |

310 |

< 1% |

90 |

< 1% |

900 |

< 1% |

Note: Data includes car shares operated by ZipCar and Maven.

MPO = metropolitan planning organization.

Source: Boston Region MPO.

CTPS and MAPC have made progress toward quantifying the impact of ride-hailing on the Boston Region MPO’s transportation network, but significant work remains to be done both in research and in shaping policy to respond to the emergence of TNCs, car sharing, and other shared-use modes. This will be an issue that the MPO will continue to discuss during the development ofthe Destination 2040 LRTP, as new information becomes available.

Figure 6-8

Car Sharing Locations in the Inner Core of the Boston Region

Source: Boston Region MPO.

In addition to analyzing current roadway capacity and potential for growth, some planning entities engage in policies and activities intended to decrease overall demand for roadway usage, especially by single-occupancy vehicles. These programs often fall under the broad title, “Travel Demand Management,” or TDM. Several MPO member municipalities, including Cambridge, Watertown, and Arlington, have established TDM programs in one form or another. MAPC maintains a resource library on TDM at https://www.mapc.org/resource-library/parking-and-transportation-demand-management/.

The MPO region is home to a number of Transportation Management Associations, or TMAs, which are membership-based, often public-private partnerships of businesses, institutions, and municipalities. TMAs often operate their own shuttle services that supplement available transit service. A list of TMA-operated shuttle services in Massachusetts is available at http://www.masscommute.com/tma_directory/.

One important element of TDM programs is appropriate management of parking supply. Research incorporating data from MPO member municipalities, Cambridge and Somerville, has proposed a causal link between increased provision of parking and increased car travel,12 while other research has estimated that drivers looking for parking comprise up to 30 percent of traffic in urban Central Business Districts.13 MAPC’s Perfect Fit Parking report has surmised that indeed, some demand for parking may be induced by the provision of parking, that is, that additional parking (and therefore additional travel and stress on the roadway network) is added by inefficient management of parking policy.14 MAPC offers MPO member municipalities assistance with parking management and policy through its Parking Management Planning program, while CTPS offers traffic impact analysis through its Community Transportation Technical Assistance program. Given the growing congestion and stress on the regional roadway network, both agencies can continue to research and plan for parking management methods to reduce overall roadway travel demand.

Another potential new frontier for managing roadway demand is the possibility of pricing roadway usage. In the MPO region, the only tolled roadway is Interstate 90, also known as the Massachusetts Turnpike. Over the last several years, there has been increasing legislative interest in the possibility of using road pricing to manage the region’s growing congestion. The MPO’s UPWP committee discussed the possibility of a study on congestion pricing during the development process of the federal fiscal year (FFY) 2020 UPWP. Ultimately, the MPO decided not to fund the study, but plan to consider it again for the FFY 2021 UPWP. While the future of road pricing initiatives in the MPO region is unclear, the MPO and staff should continue to monitor developments and could potentially study the impacts of various paradigms for road pricing.15

During fall 2017 and winter 2018, MPO staff collected feedback on transportation issues, needs, and opportunities from municipal planners and officials, transportation advocates, members of the general public, and other stakeholders. The following sections focus on roadway capacity management and mobility issues by theme.

Respondents have noticed an increased demand for dense urban living and auto-free lifestyles. The latter has been further enabled by increased ride-hailing options. They predicted continued interest in more “European” streets with sidewalk cafes and biking/pedestrian-only zones. One respondent felt that people should not expect to be able to park in downtowns. Others predicted an increase in “battles” over roadway space with increases in online deliveries, ride-hailing services, and demand for protected cycling infrastructure and dedicated bus lanes.

Generally, respondents expressed a desire for access to alternative modes of transportation to mitigate the impacts of congestion. Respondents wanted people to have the freedom to choose walking and biking and the infrastructure to encourage more to do so. In addition, respondents identified the need for more transportation options in the suburbs and for planners and policymakers to work with communities and regions to create first-and-last-mile connections. Many of the suggestions specific to transit and bicycling/walking are covered in the sections, below. Other proposed solutions included

The MPO and transportation policy-setting entities face a major challenge in regards to managing capacity and mobility on the region’s roadway network. Congestion is increasing along with the region’s population and economic activity, and the ability to add lane miles to the region’s roadway network is limited.

The increasing congestion affects not only drivers but many surface transit riders as well, and policymakers face pressure to deal with it while also accommodating diverse needs and modes. Indeed, from the perspective of managing capacity of people, modes other than the single-occupancy vehicle may be more spatially efficient. The introduction of new technologies and paradigms such as ride-hailing and car sharing pose fresh challenges and an uncertain future, and may make the congestion situation worse.

While models such as TDM programs have considerable room to grow and may help take some stress off of the roadway network, they are currently limited in scope and require considerable additional research. The MPO must monitor all of these considerations carefully, while assisting municipalities to understand the challenges now and in the future. Additional research will help the MPO to monitor the performance of the region’s roadway network in the future.

The ability to move freight and heavy vehicles more efficiently is critical to economic vitality for both the state and region. The dominant freight transportation mode in the Boston region is trucks. While freight also enters or leaves the region via airfreight, railroad, or ocean shipping, in almost all instances, goods traveling by these other modes must use trucks to connect with local origins and destinations. A number of specialized terminals, both publicly and privately owned, enable freight to transfer between different modes, and critically, within the region’s road network.

The MPO has a leading role in improving the region’s road network, but it also supports, and where possible facilitates improvements to other freight modes and associated terminals. The MPO collaborates with freight service providers and terminal operators, both public and private, throughout the region in its ongoing efforts to ensure region-wide freight and logistic efficiency.

The following section details freight-specific needs identified through MPO staff research and analysis. Specifically, those needs focused on

Trucks, both commercial and private, share the regional roadway network with light vehicles. Measuring, managing, and reducing delay in the region’s road network is an important and defined responsibility of the MPO and is the ongoing work of the MPO’s CMP. In conjunction with population and economic growth, freight movements are expected to increase steadily between now and 2040. Growth in heavy vehicle traffic will contribute to traffic congestion, but should not be considered the cause of congestion. The primary source of peak-period congestion will continue to be the large numbers of light vehicles generated by regional commuting and discretionary travel by households.

Strategies to affect mode shift in the MPO region are less applicable to freight, since no practical alternatives to trucks exist for final distribution of consumer goods to retail locations, as well as for most industrial logistic needs. Railroads have been successful in increasing intermodal shipments using high-capacity double-stacked rail services to modern terminals, such as the one in Worcester, but have also concentrated local freight delivery on a smaller number of high volume customers. Strategies, such as moving the CSX Intermodal yard to Worcester from Beacon Park in Allston, slow the growth of trucks on the national interstate system, but also add increasing numbers of trucks, and truck vehicle-miles of travel (VMT), to roadways within the Boston Region MPO. The impacts of larger shipping vessels using the expanded Conley Terminal rather than New York area terminals are similar; less statewide truck VMT but more MPO VMT.

The FHWA also requires states and MPOs to track truck travel reliability on the interstate system to better understand performance of the nation’s freight system. The applicable measure in this case is the Truck Travel Time Reliability (TTTR) Index. This measure compares longer (95th percentile) truck travel times to average (50th percentile) truck travel times—the greater the difference between these two travel times is on an interstate segment, the less reliable truck travel on that segment is considered to be. Information on the development of these targets is described in more detail in Chapter 5 of the Destination 2040 LRTP.

In 2018, MassDOT calculated baseline TTTR Index values and established performance targets using CY 2017 truck travel time data. As with the all-passenger travel time reliability targets, MassDOT set the two-year and four-year targets equal to the CY 2017 baseline. Table 6-11 displays these values. The MPO voted to support MassDOT’s four-year TTTR Index target in 2018, and Table 6-11 also includes the Boston region’s CY 2017 baseline index value. As the table shows, the Boston region’s TTTR baseline value is higher than the one for Massachusetts, indicating that truck travel on the region’s interstate network is generally less reliable than on Massachusetts’s interstates as a whole.

Table 6-11

Truck Travel Time Reliability Performance Measure Baselines and

MassDOT Performance Targets

Network |

Measure |

Cumulative Traffic |

2017 Measure |

Two-Year Target |

Four-Year Target |

Massachusetts—Interstate Highway System |

Truck Travel Time Reliability Index |

1,150 |

1.85 |

1.85 |

1.85 |

Boston Region—Interstate Highway System |

Truck Travel Time Reliability Index |

354 |

2.55 |

n/a |

See Massachusetts Target |

aThe two-year target reflects conditions as of the end of CY 2019, and the four-year target reflects conditions as of the end of CY 2021.

CY = calendar year. MassDOT = Massachusetts Department of Transportation. NHS = National Highway System.

Sources: National Performance Management Research Data Set, Cambridge Systematics, MassDOT, and the Boston Region MPO.

Routine questions about numbers of trucks and their percent of traffic usually go unanswered because total traffic volumes are obtained more frequently than the more complex process of classifying vehicle types in those volumes. Although MPO staff has assembled a set of reliable truck data, for truck model estimation purposes, it is not sufficient and detailed enough to use for infrastructure project selection. With the completion of an envisioned truck model estimation effort, working estimates of truck traffic throughout the region’s network will become available to support any regional planning effort.

The data that is available to staff suggests that the express highways which have been flagged as regional bottlenecks in the Roadway section of this chapter, are also sections of the road network with a large number of trucks. It is generally the case that the express highways will have a higher percentage of trucks than arterial streets in the region. However, the percent of trucks will vary from bottleneck to bottleneck. A safe assumption about addressing the needs of freight in 2040 is that improving the express highway bottlenecks as a group will likely be more beneficial than improving the arterial bottlenecks.

The analysis of truck traffic is further complicated by the fact that the temporal distributions of truck and light vehicle traffic are different. Trucks serving urban areas tend to start their day early, and often finish up their travel before the PM peak. However, this pattern of avoiding the evening rush hour is more pronounced for arterial traffic, and significant truck traffic on the express highways is experiencing both AM and PM congestion with light-vehicle commuters.

Consideration of the mobility needs of freight adds weight to the benefits of relieving congestion on the region’s limited-access express highways. Estimating the truck traffic flows impacted at individual bottlenecks on both express highways and arterials will require further refinement of the MPO’s truck modeling capabilities.

Most public input relevant to the movement of freight in the MPO region and to the MPO’s freight program is covered in the Roadway section above. However, specific freight-related comments are included below.

The growing congestion and delay in the region’s roadway network affects freight operators like it does drivers and surface transit riders. Additionally, freight operators making deliveries in the Inner Core area increasingly face competition for scarce curb space, as bus lanes, bike lanes, and TNC dropoffs demand their share as well. For the most part, concerns about freight congestion can be addressed through the MPO’s roadway actions, but policymakers should continue to consider the implications of freight transportation.

The MPO region is served by a variety of transit services. These services include:

Like the region’s roadway system, the region’s transit services and networks face reliability and capacity-management concerns. To date, most of the Boston Region MPO’s target funding for capital projects goes to support the roadway network, bicycle, and pedestrian facilities; with the region’s RTAs, the MassDOT Rail and Transit Division, and others supporting investment in the transit system. In the past, the MPO has flexed some of its highway funding to transit projects to support the construction of the Green Line Extension and Assembly Square Orange Line station.

In addition, the MPO has also made investments in the transit system through its Suburban Mobility Program, which evolved into the Clean Air and Mobility Program. The MPO currently has allocated CMAQ funds in the TIP for a new Community Transportation Program in FFYs 2021 through 2024, and conducted a study to determine the criteria for that program through the FFY 2018 UPWP. The Community Transportation Program is expected to fund and help plan fiscally sustainable mobility solutions with an emphasis on first-and-last-mile connections. The MPO also supports the distribution of federal transit grant funds by the Rail and Transit Division.

A number of different planning processes come together to address capacity management and mobility performance, issues, and needs on the transit system. The MPO performs ongoing system-level and project-level analyses for the LRTP and for transit service operations and capital improvements for MassDOT and the MBTA. The following sections describe transit-specific needs identified through MPO research and analysis.

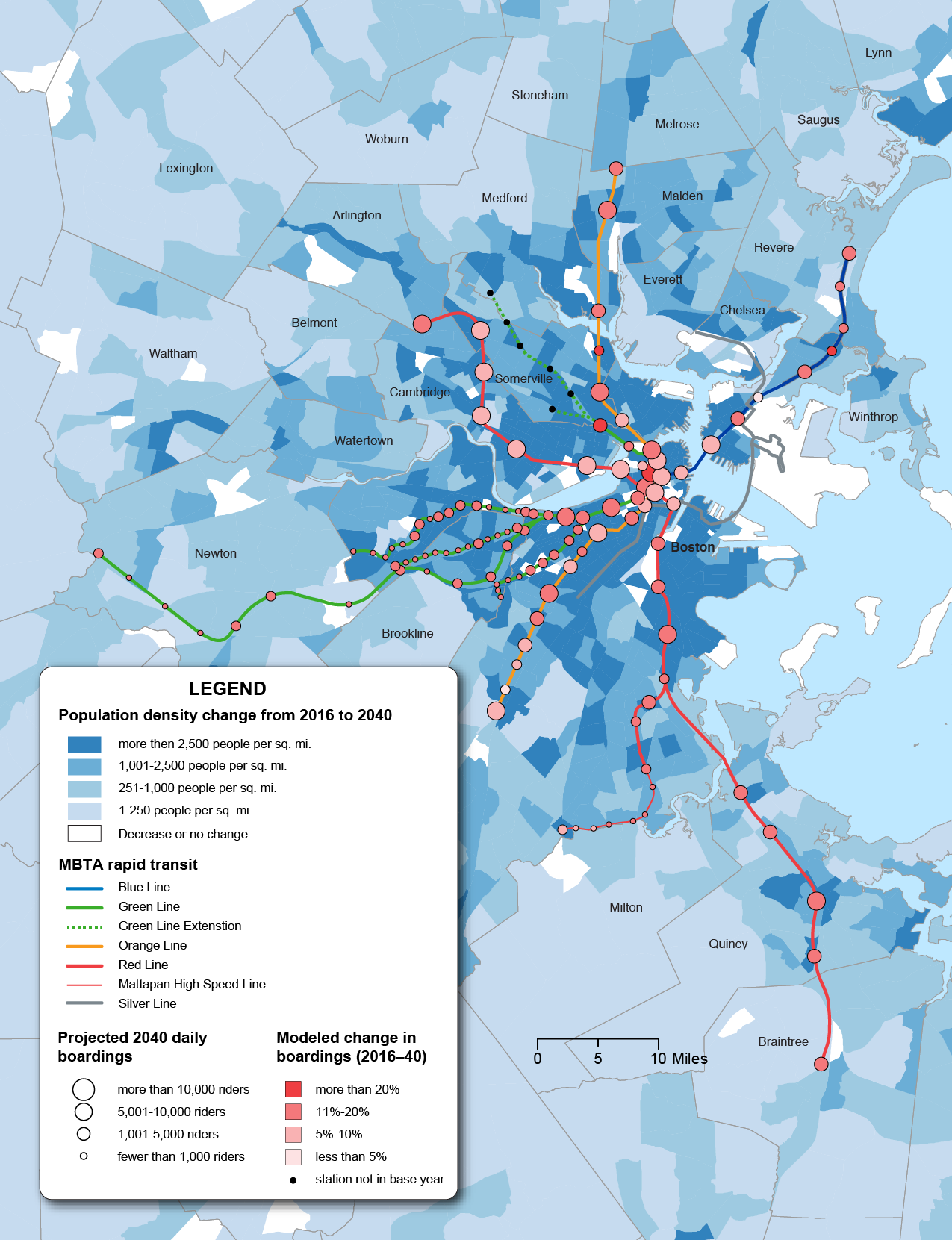

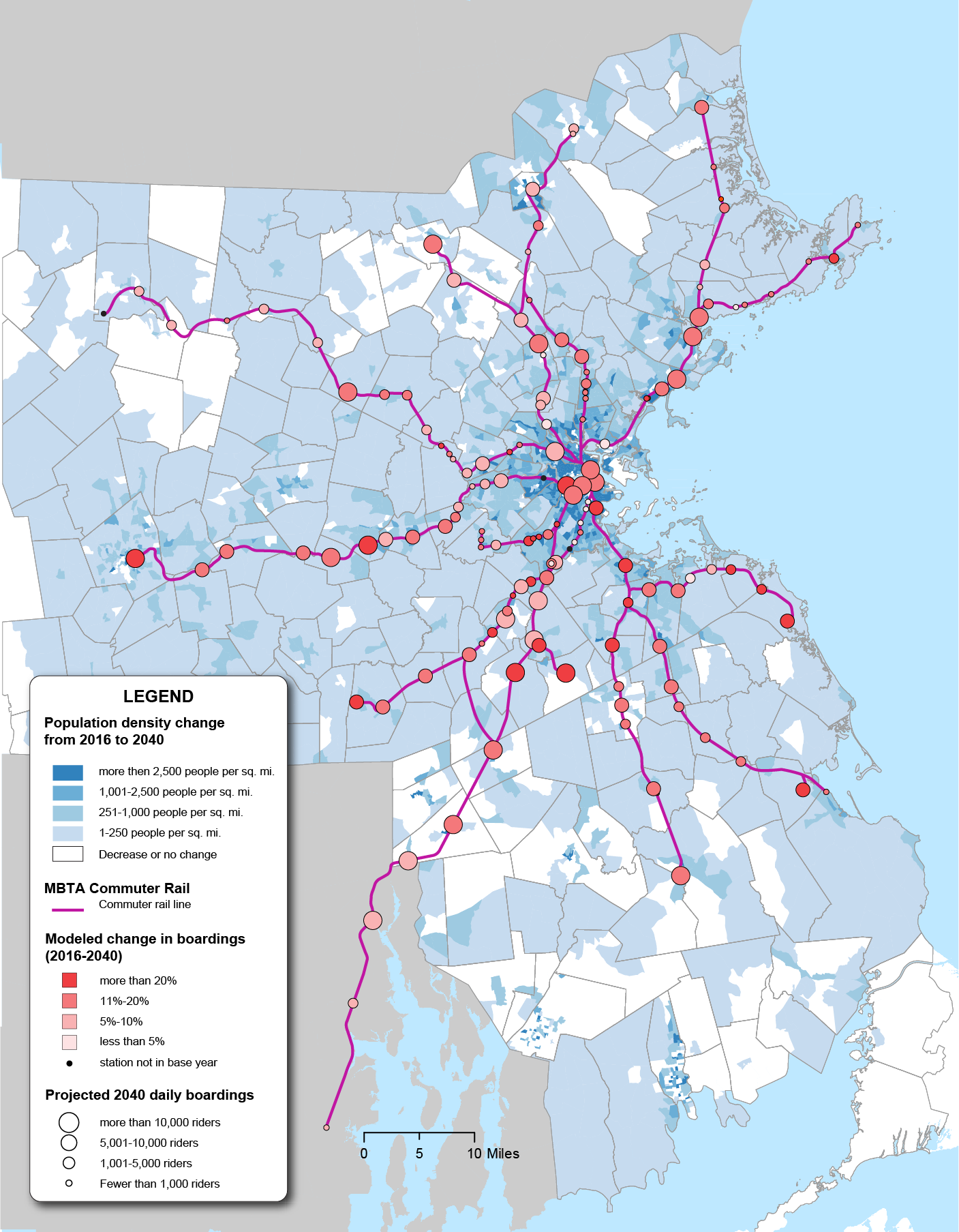

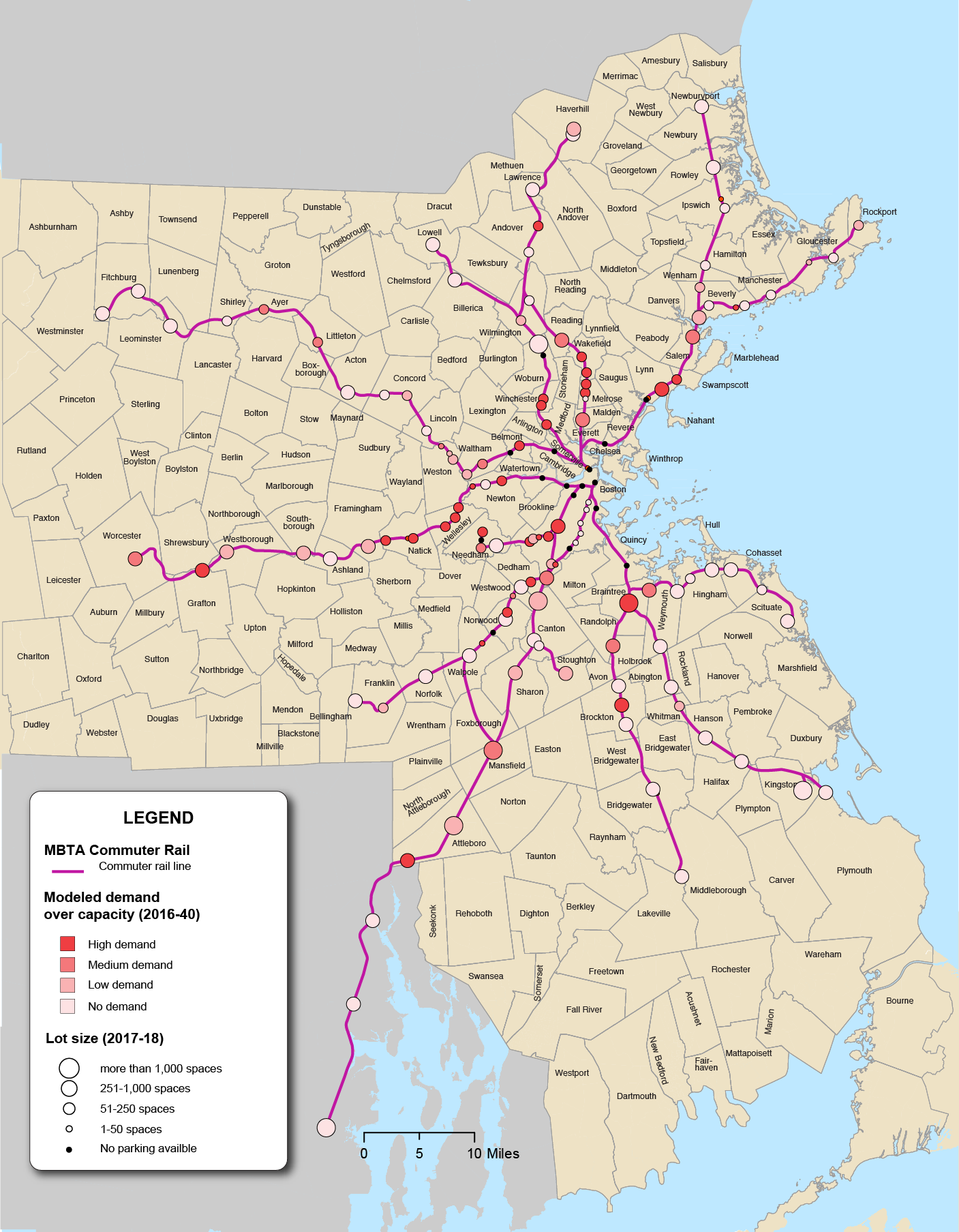

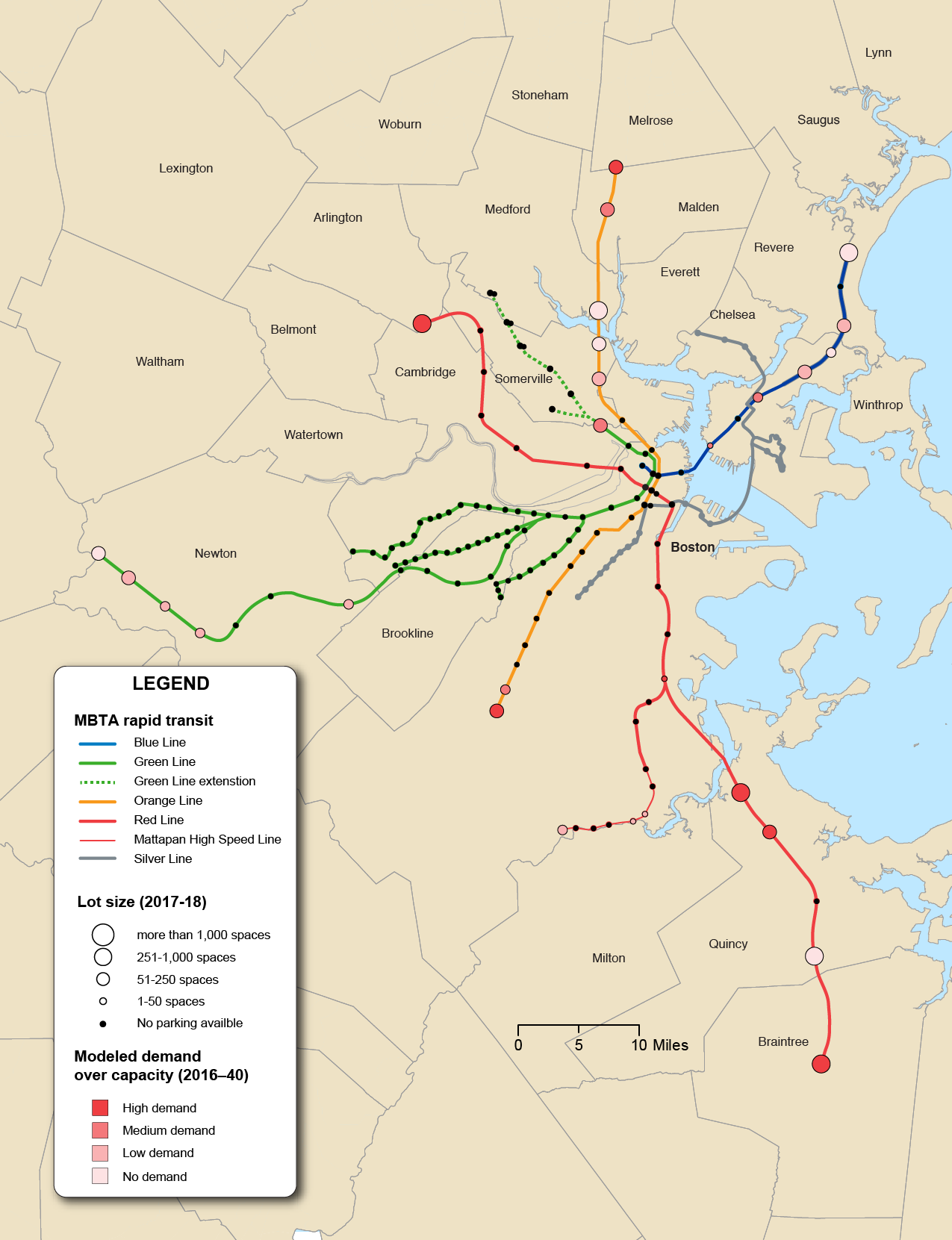

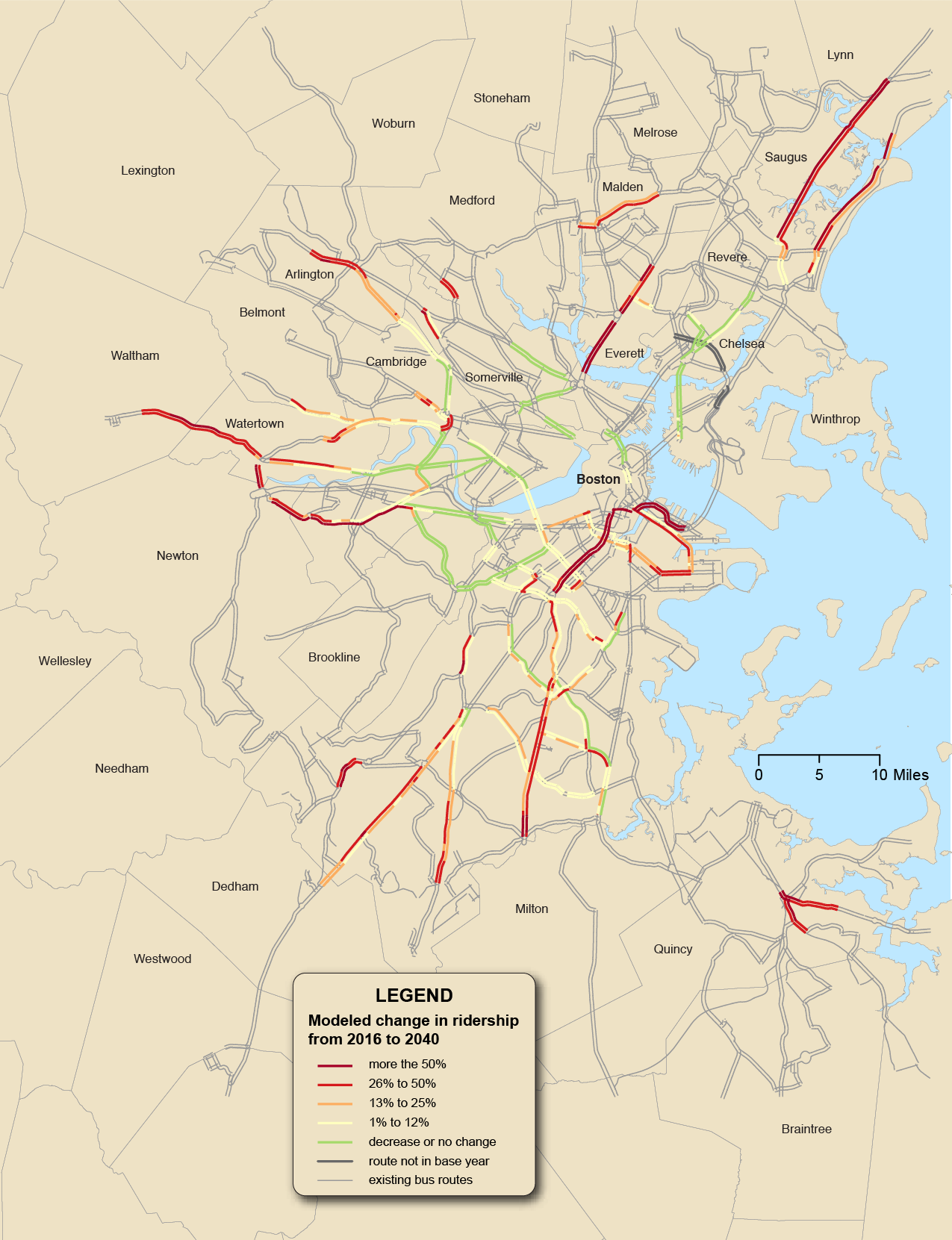

The following tables and figures show the current (2016) and projected (2040) daily boardings on the MBTA rapid transit and commuter rail networks, as projected by the MPO’s travel demand model—assuming no additional transit projects are constructed. This is also known as No-Build conditions. The figures also show the projected change in population density in relation to transit usage in the Boston region.

Table 6-12

Rapid Transit Boardings, 2016–40

Rapid Transit Lines |

2016 Daily Boardings |

Projected 2040 Daily Boardings |

Modeled Change in Daily Boardings |

Blue Line |

78,360 |

88,794 |

13% |

Green Line |

210,469 |

264,593 |

26% |

Green Line—Central Subway |

147,521 |

171,783 |

16% |

Green Line—B |

18,094 |

21,005 |

16% |

Green Line—C |

9,754 |

11,022 |

13% |

Green Line—D |

19,055 |

37,505 |

97% |

Green Line—E |

16,045 |

23,277 |

45% |

Orange Line |

223,605 |

247,641 |

11% |

Red Line |

298,272 |

333,601 |

12% |

Mattapan |

3,370 |

3,804 |

13% |

Silver Line |

33,340 |

63,866 |

92% |

Total |

847,416 |

1,002,298 |

18% |

Source: Boston Region MPO.

Table 6-13

Commuter Rail Boardings, 2016–40

Commuter Rail Lines |

2016 Daily Boardings |

Projected 2040 Daily Boardings |

Modeled Change in Daily Boardings |

Fairmount |

2,652 |

3,030 |

14% |

Fitchburg |

9,302 |

10,535 |

13% |

Franklin |

11,671 |

13,673 |

17% |

Greenbush |

6,109 |

7,163 |

17% |

Haverhill |

7,112 |

7,910 |

11% |

Kingston/Plymouth |

6,095 |

7,283 |

19% |

Lowell |

10,925 |

11,971 |

10% |

Middleborough/Lakeville |

6,863 |

8,118 |

18% |

Needham |

6,672 |

7,705 |

15% |

Providence/Stoughton |

25,728 |

28,956 |

13% |

Newburyport/Rockport |

15,019 |

16,944 |

13% |

Worcester |

18,636 |

22,852 |

23% |

Total |

126,784 |

146,139 |

15% |

Source: Boston Region MPO.

Figure 6-9

Rapid Transit Boardings, 2016–40

Source: Boston Region MPO .

Figure 6-10

Commuter Rail Boardings, 2016–2040

Source: Boston Region MPO.

Rail rapid transit is expected to see about 18 percent more boardings while commuter rail ridership is projected to increase about 15 percent. The increase in boardings on the Silver Line Bus rapid transit serving the growing Seaport District is due to the recently added SL3 route (added after 2016) that has key sections in dedicated right-of-ways. The increase on the Green Line D and E branches are due to the extension of the Green Line to College Avenue in Medford and Union Square in Somerville.

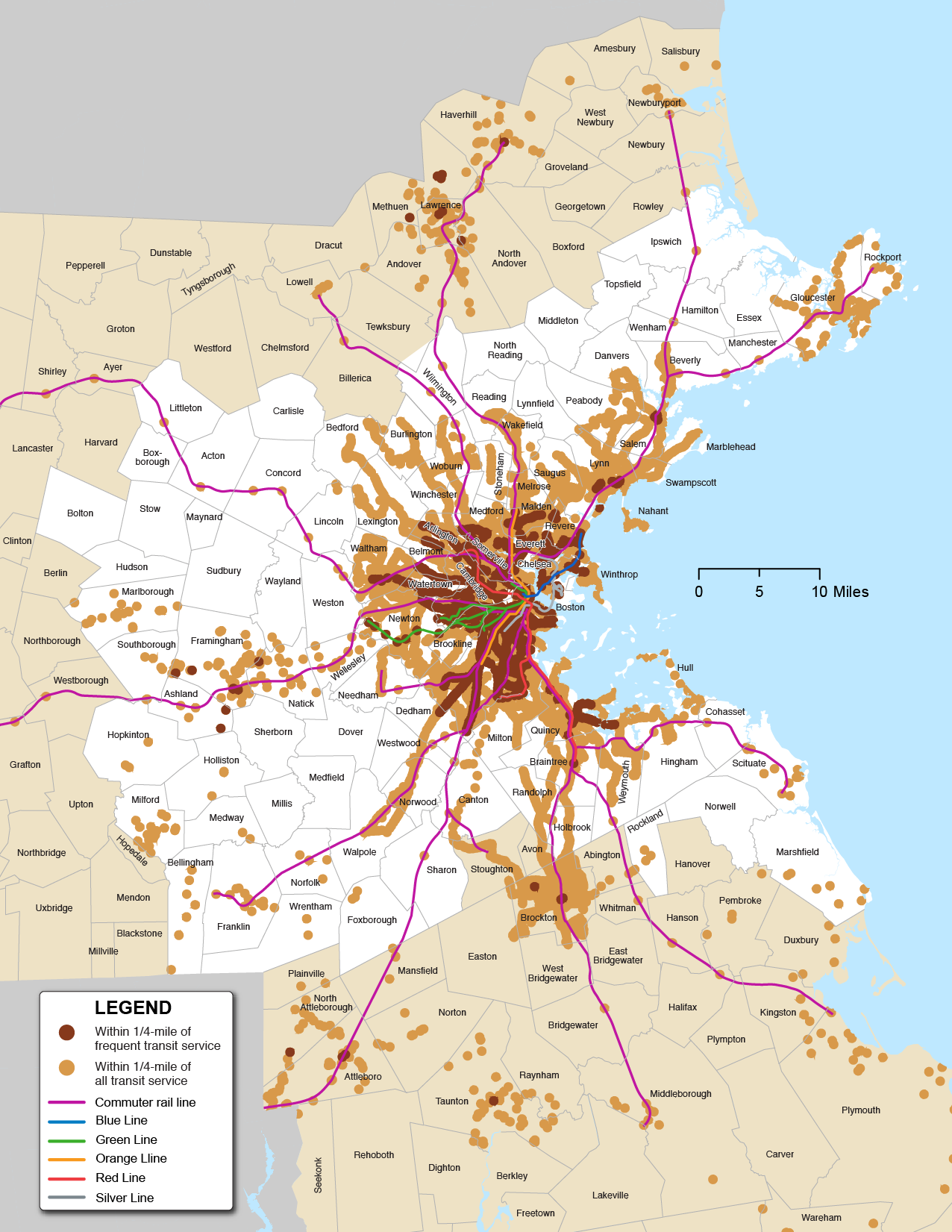

One important element to improving the regional transportation system is the accessibility of transit to housing, employment, and other key destinations. Access to safe, reliable, frequent transit gives travelers options other than single-occupancy vehicles; but the provision of such service alone is insufficient. High-quality transit must be supported by appropriate land use around its stops. The following figures should thus be understood as describing a situation that can be shaped by future MPO and other public policy.

Tables 6-14 and 6-15 give an overview of the portion of the MPO’s population and employment that fall within one-quarter and one-half mile of an MBTA or RTA bus or ferry stop or an MBTA rapid transit or commuter rail station. It is further broken down by provision of frequent transit service, according to the definition laid out for dense areas in the MBTA Service Delivery Policy—service no more than every 15 minutes during weekdays and 20 minutes on weekends. A map of the Inner Core, Regional Urban Centers, Maturing Suburbs, and Developing Suburbs was shown in Chapter 2, Figure 2-2.

Table 6-14

Access to All Transit: Households and Employment 2016

Transit Market Area |

Employment (Number of Jobs) |

Percent of Employment |

Households |

Percent of Households |

Population |

Percent of Population |

Inner Core |

1,006,000 |

|

616,800 |

|

1,487,900 |

|

Within 1/4 mile |

911,500 |

91% |

562,200 |

91% |

1,350,300 |

91% |

Within 1/2 mile |

989,200 |

98% |

612,400 |

99% |

1,475,200 |

99% |

Regional Urban Centers |

307,700 |

|

234,200 |

|

566,200 |

|

Within 1/4 mile |

176,600 |

57% |

137,800 |

59% |

326,900 |

58% |

Within 1/2 mile |

248,900 |

81% |

185,200 |

79% |

442,000 |

78% |

Maturing Suburbs |

470,200 |

|

339,800 |

|

871,900 |

|

Within 1/4 mile |

159,200 |

34% |

91,800 |

27% |

229,000 |

26% |

Within 1/2 mile |

265,200 |

56% |

170,400 |

50% |

428,600 |

49% |

Developing Suburbs |

139,700 |

|

121,200 |

|

319,900 |

|

Within 1/4 mile |

11,600 |

8% |

7,600 |

6% |

19,400 |

6% |

Within 1/2 mile |

27,500 |

20% |

19,400 |

16% |

50,000 |

16% |

Source: Boston Region MPO .

Table 6-15

Access to Frequent Transit: Households and Employment 2016

Transit Market Area |

Employment (Number of Jobs) |

Percent of Employment |

Households |

Percent of Households |

Population |

Percent of Population |

Inner Core |

1,006,000 |

|

616,800 |

|

1,487,900 |

|

Within 1/4 mile |

714,600 |

71% |

369,400 |

60% |

886,200 |

60% |

Within 1/2 mile |

866,900 |

86% |

512,700 |

83% |

1,231,900 |

83% |

Regional Urban Centers |

307,700 |

|

234,200 |

|

566,200 |

|

Within 1/4 mile |

31,300 |

10% |

20,500 |

9% |

46,400 |

8% |

Within 1/2 mile |

58,500 |

19% |

48,400 |

21% |

112,700 |

20% |

Maturing Suburbs |

470,200 |

|

339,800 |

|

871,900 |

|

Within 1/4 mile |

4,000 |

1% |

2,500 |

1% |

6,400 |

1% |

Within 1/2 mile |

11,100 |

2% |

7,500 |

2% |

18,500 |

2% |

Developing Suburbs |

139,700 |

|

121,200 |

|

319,900 |

|

Within 1/4 mile |

0 |

0% |

0 |

0% |

0 |

0% |

Within 1/2 mile |

30 |

< 1% |

50 |

< 1% |

120 |

< 1% |

Source: Boston Region MPO .

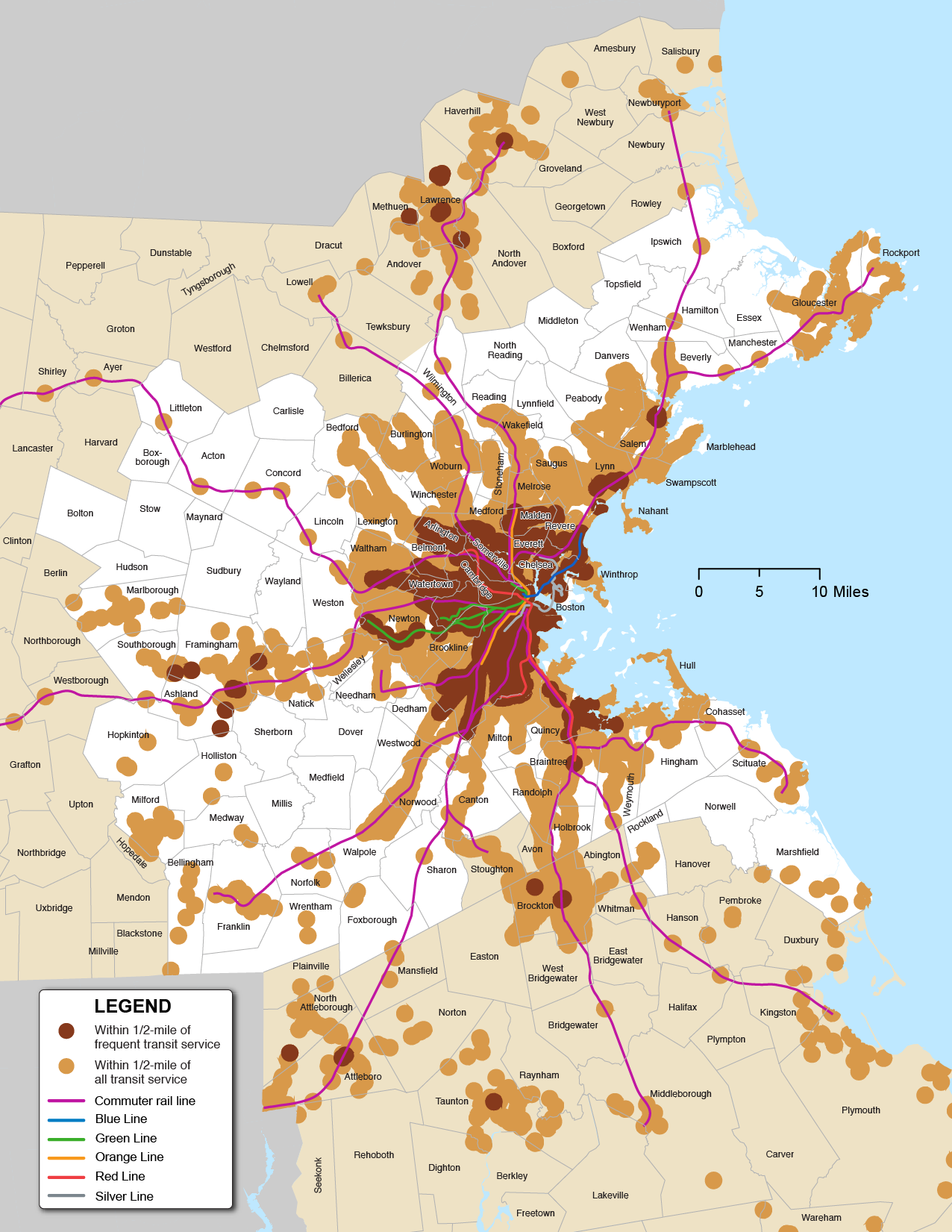

Figures 6-11 and 6-12 show the areas within one-quarter mile and one-half mile of any transit and/or frequent transit service in the Boston region. As these analyses show, there are several, potentially complementary or overlapping paths to increasing transit’s share of the Boston region travel market in the coming years. Transit’s coverage, already significant,can be expanded throughout the region; transit’s frequency, high in some areas and not in others, can be increased to attract new riders; and land use can be planned to better align with transit. The MPO can support these efforts through planning, studies, and careful shepherding of available funds.

Figure 6-11

Areas within One-Quarter Mile of Transit and Frequent Transit in the Boston Region

Source: Boston Region MPO.

Figure 6-12

Areas within One-Half Mile of Transit and Frequent Transit in the Boston Region

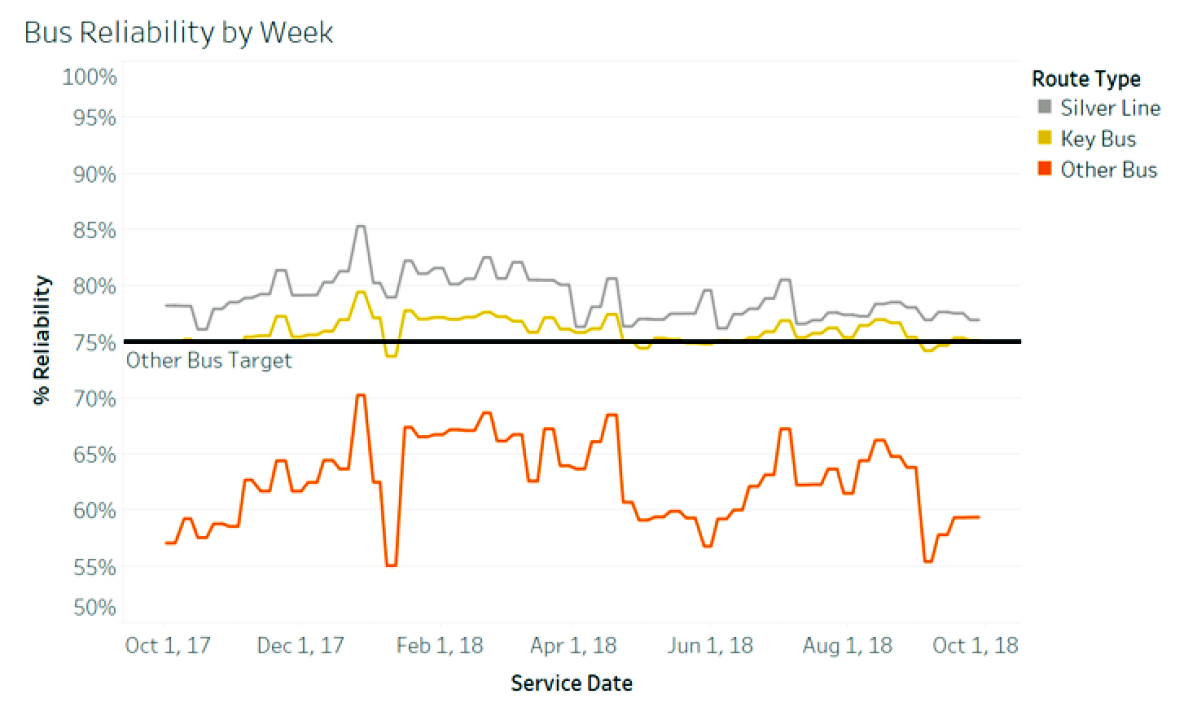

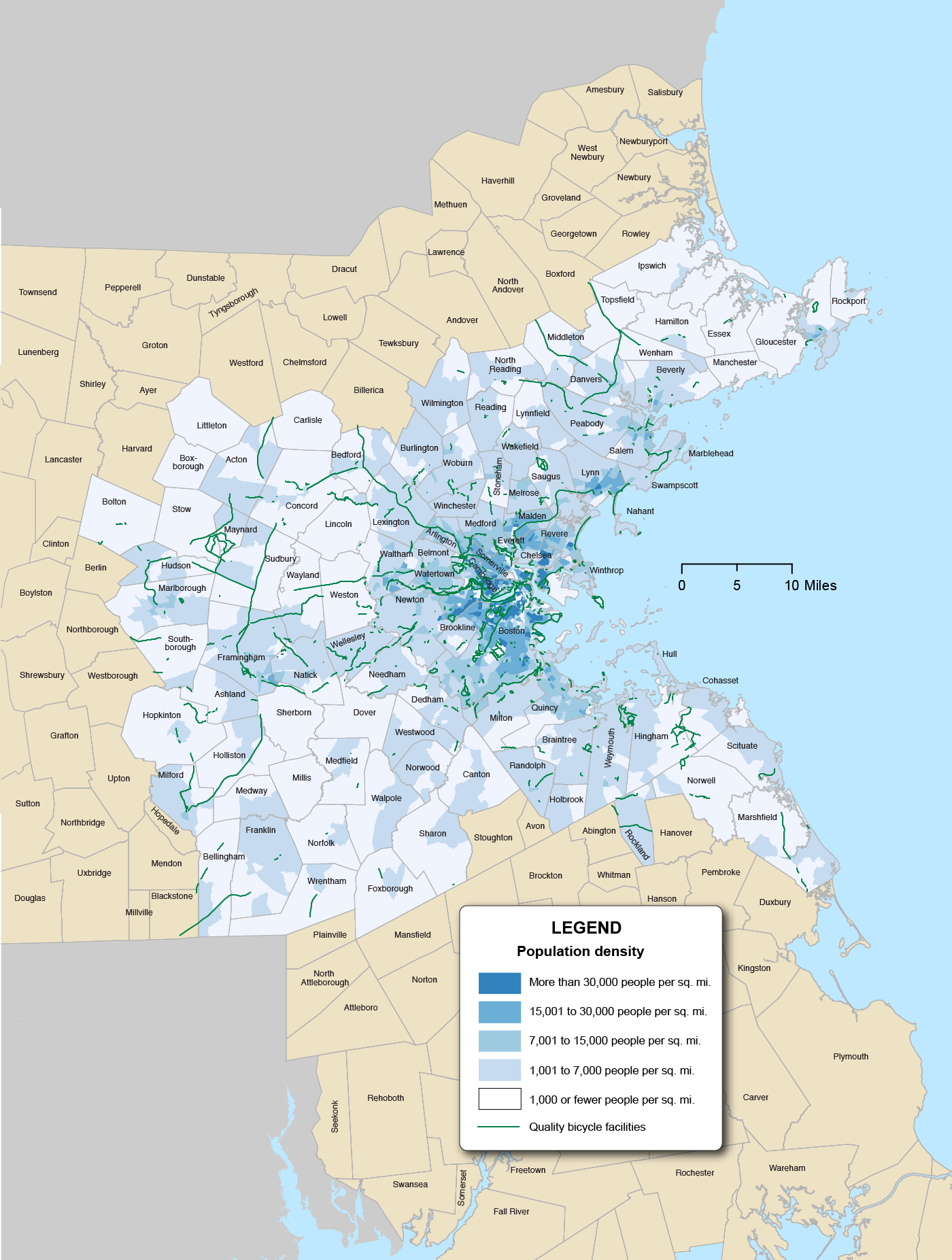

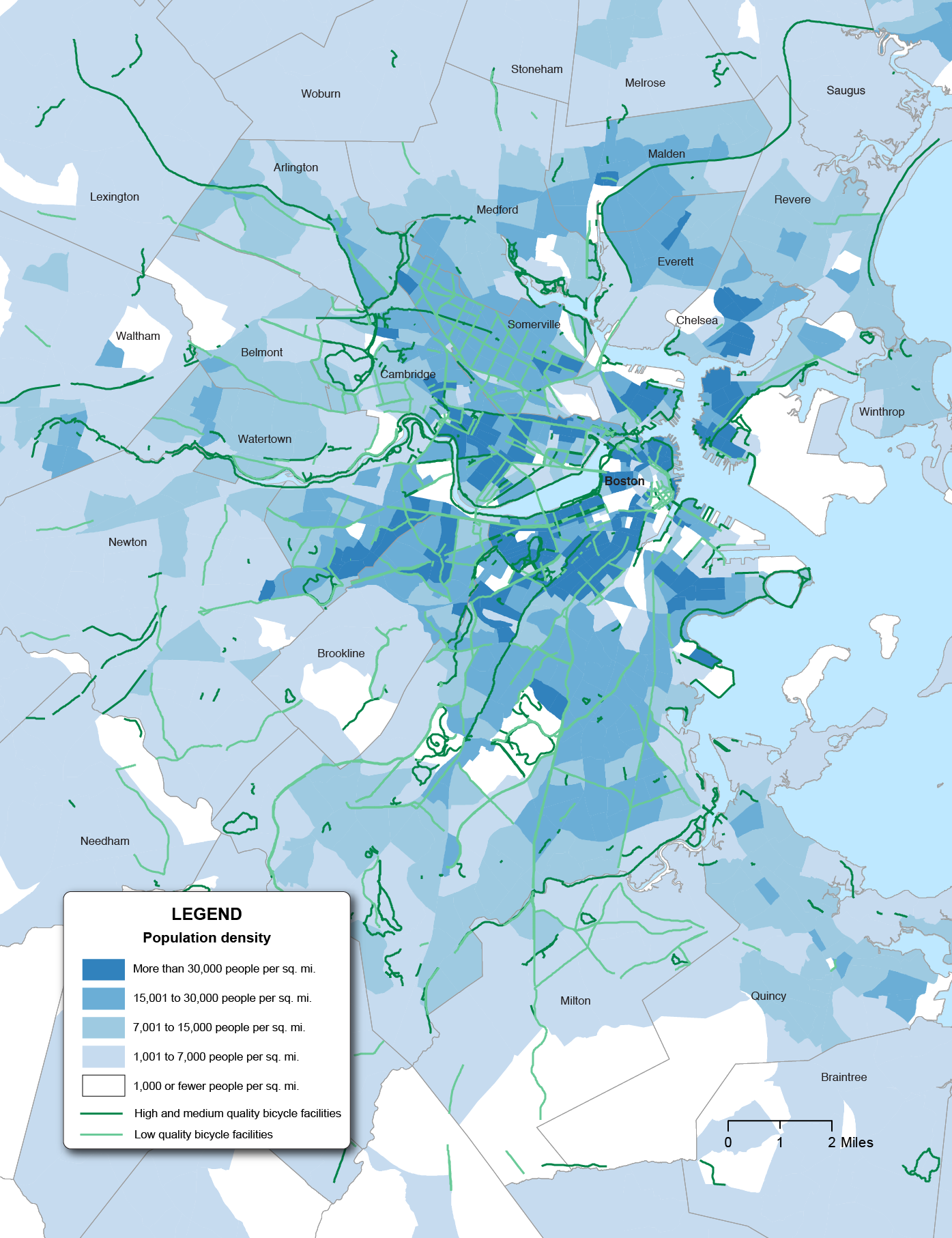

Source: Boston Region MPO.